We all start somewhere, and before we can start with the basic outline of my methodology, let me tell you where it all came from.

Introduction

I started with Elliott Wave theory. I liked the prospect of understanding market behaviour through the concept of fractals and repeating patterns. I soon learned that EW is a confirmation tool that tells you when patterns might be completing, so that a trade might set up.

In the social arena, I met my dear friend J. From conversations, it turned out that he was much like me. A ton of knowledge, but unsure how it all fits together, and therefore simply locked in scalp mode. At some point, he shared his basic scalp model with me. Said he waited for an imbalance, a contraction, and if all of that would undercut and reclaim, it triggered a consistent bread and butter scalp.

What he shared with me became the basis of my Diagonal Entry Model, and consistently executing just that setup gave me everything else I have designed.

It All Starts With Trend

My trading courses will take you on a journey that explains and demonstrates concepts and edges that depend on a trending EMA9.

That is right: I need a trend to perform. My base timeframe is the 2 minute (M2), and I use the 10 minute timeframe for directional bias (M10). The hourly timeframe (H1) tells me if I am trading against the trend, with the trend, or inside a balance zone (line to line).

Trend Sets Up Directional Trades

When price is trending, we can make money. Initially, we have to use continuation models to participate (break outs in uptrends and break downs in downtrends). When continuation fails, we can look for a reversal to play a bounce or better.

You read that right: reversals only set up when continuation fails.

Continuation fails in only two ways:

Failed Breaks;

Failed Swings.

The Diagonal Entry Model

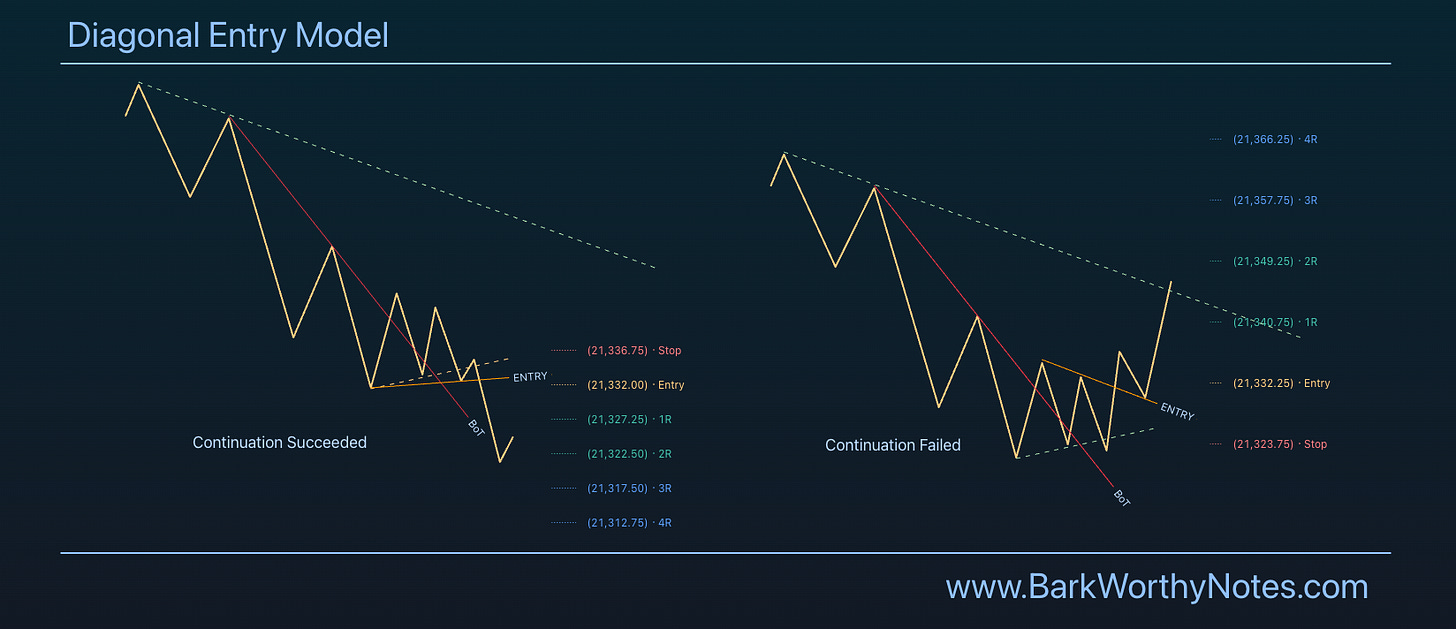

I use a simple configuration of three diagonals to look for continuation and reversals. The first diagonal informs us that the trend is likely going to take set up a bounce soon. Once that bounce forms, a pullback will give the Entry Diagonal, and when all criteria are met, this setup has a high probability of following through, with the target always the third “Target Diagonal”.

In reality, it is super simple. Here is a short diagram that illustrates the principle.

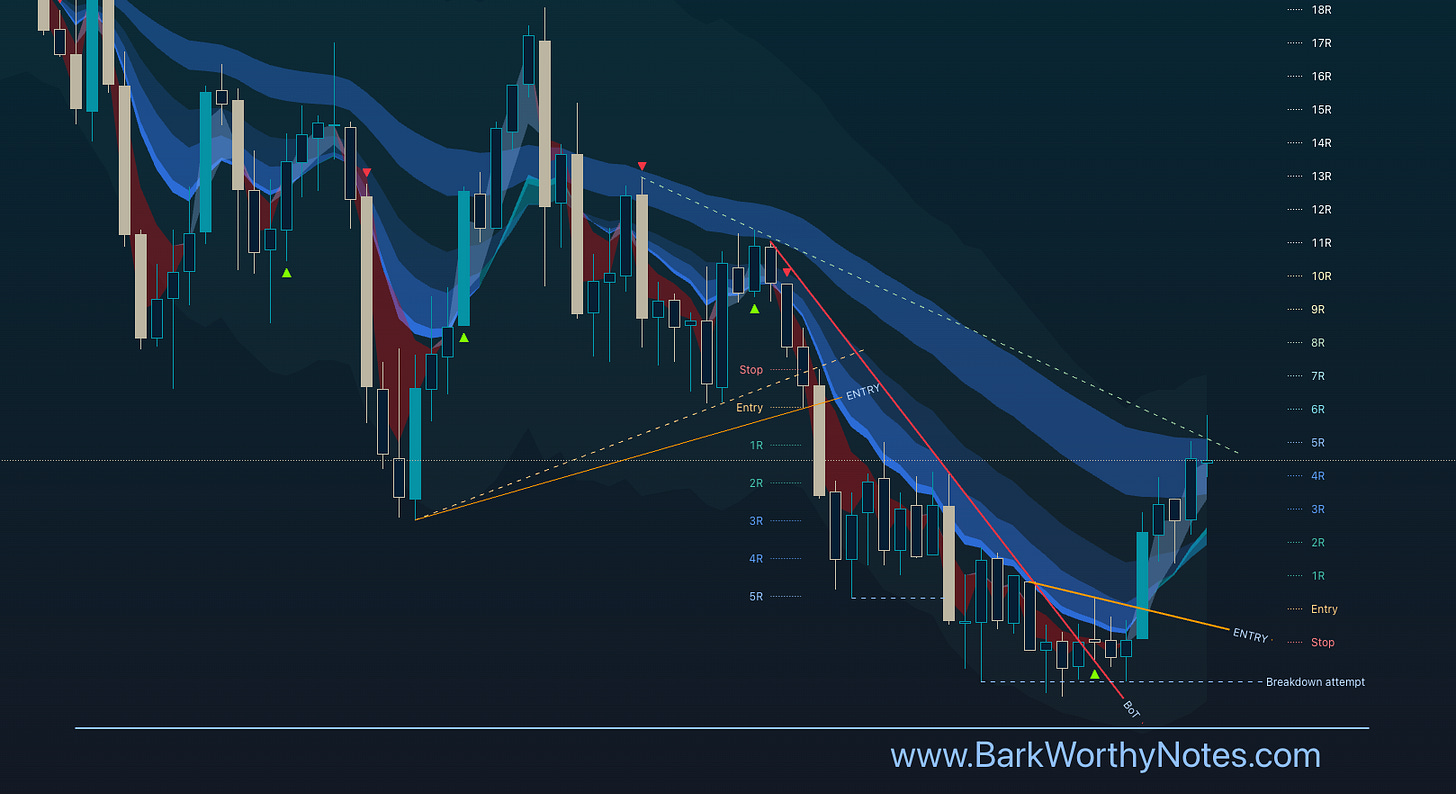

Here is how that works on a price chart. Can you spot the similarities?

This is a consistent and repeatable way of approaching the markets. Combined with my parameters for risk and position management, it compounds gains from nearly all setups. We take these trades in the Discord every day, using M2 for entries and M10 for trend.

If this inspires you, take a chance, and choose to commit to this simple strategy. Just the fact that you stop strategy hopping and simply commit to this standardised way of doing things, would be life changing for you.

So let’s have a look at the basic model and its parameters, how to draw diagonals, what diagonals to avoid, et cetera.