#ES_F / #NQ_F Trade Plan July 11

Navigating the S&P500 and Nasdaq 100 futures with Barky's Three Level Trade Plans

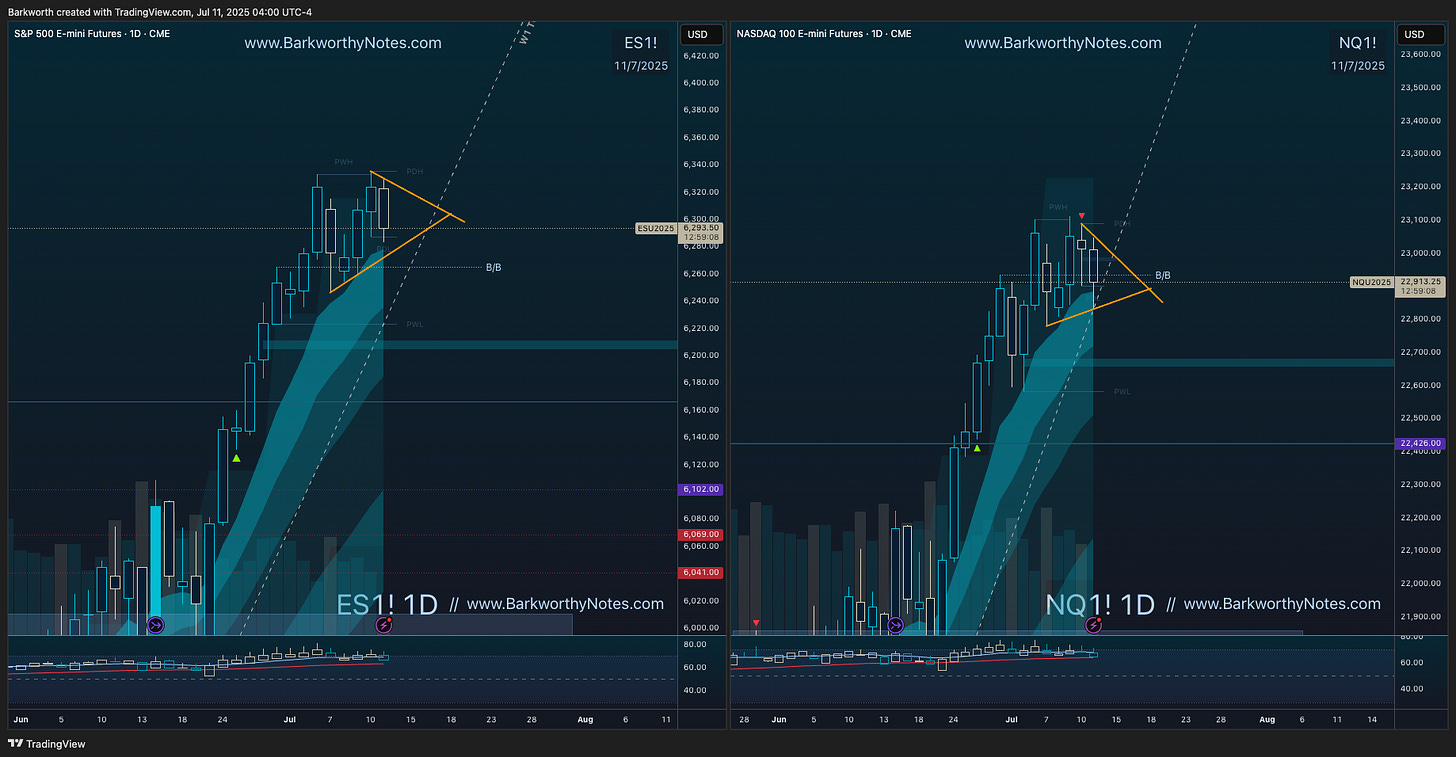

Daily Chart Update

Remarkably, ES triggered the proposed upside path while NQ attempted the proposed flush and gave that anticipated failed breakdown the plan said to look for. The US pre market then produced some scalp opportunities, with the pullback into the US open setting up the add before ES took out the old high and both indices gave short.

Plan result: 43 points $ES_F and 119 points $NQ_F. These trades are recapped in today’s educational section.

Four days sideways confirms the plan for this week, where I proposed to expect consolidation or pullbacks. The 4 hourly chart is currently setting up pullbacks and we could see a very bearish Friday, but at the same time, we have mature D1 EMA9 consolidations here, and it is time for buyers to lead.

Dips towards the lower parts of these ranges can be bought, but price loses D1 EMA9 there now, and if buyers fail the hold these supports, the daily uptrend ends, initiating a search for a daily higher low.

The plan is initially to look for failed breakdowns to add longs (swings), or jump on break outs if they trigger, while for our day trades we will continue to participate in the hourly swings inside these daily ranges. Our week has paid solid bread and butter.

Did you know that Barky’s Diagonal Entry Model truly comes to life when price is ranging? Long at support in line with the Root Timeframe parameters, over and over again, until it fails.

Revised levels, trade plans, trade recaps, charts, key levels, and trade plan video with video trade reviews, all in today’s newsletter.

Table of Contents

This Week’s Plan and the Coming Session;

Plan - New Three Level Trade Plans for $ES_F and $NQ_F;

$VIX - Implied Volatility (Bonus);

Video - Trade Plan Video with Previous Session Trade Recaps;

Recap Charts - Previous Session Setup Charts and Education.

For methodology, follow this link: Barky’s Three Level Trade Plans

Three Diagonals Will Change Your Life

This Week’s Plan

The plan for this week as published on July 6 was to expect consolidation and a potential pullback as price was climbing on fading volume and RSI weakness, signalling potential exhaustion.

Key Trigger: Losing D1 EMA9 sparks consolidations or pullbacks.

Pullback Targets: D1 EMA21 aligns with our new weekly Trend Control Diagonals (see W1 update above).

Break out supports: ES $6153 - NQ $22426

Key weekly supports: ES $5959 - NQ $21567

Plans for the Coming Session

Both indices have swept all proposed upside targets, including the old highs, and H4 is setting up EMA50 reversals now, still consolidating within the H4 EMA50 Continuation Models that we have traded all week. With yesterday’s failed break outs, continuation is failing, and if buyers lose H4 EMA9 now, sellers will attempt to confirm 4 hourly reversals and hourly downtrends to attempt breakdowns.

Bullish setup complete. Both indices took out the high. H4 EMA9 had to lead and failed.

Still in play:

Bearish: Short with H4 EMA9 pushing, to sweep last week’s lows (ES Short $6223, NQ $22581).

Reversal Triggers:

- TRIGGERED: failing to reach and/or hold last week’s highs signals failed breakouts;

- no new highs after H4 EMA50 backtests signals failed swings (activated today).

Barky’s Three Level Trade Plans provide precise entries to navigate these setups.

Unlock Winning Trades for Just $12/Month!

Get Barky’s Three Level Trade Plans for ES and NQ, plus exclusive charts, precise levels, trade plan videos, and session recaps. Don’t miss this week’s breakout setups - subscribe now!