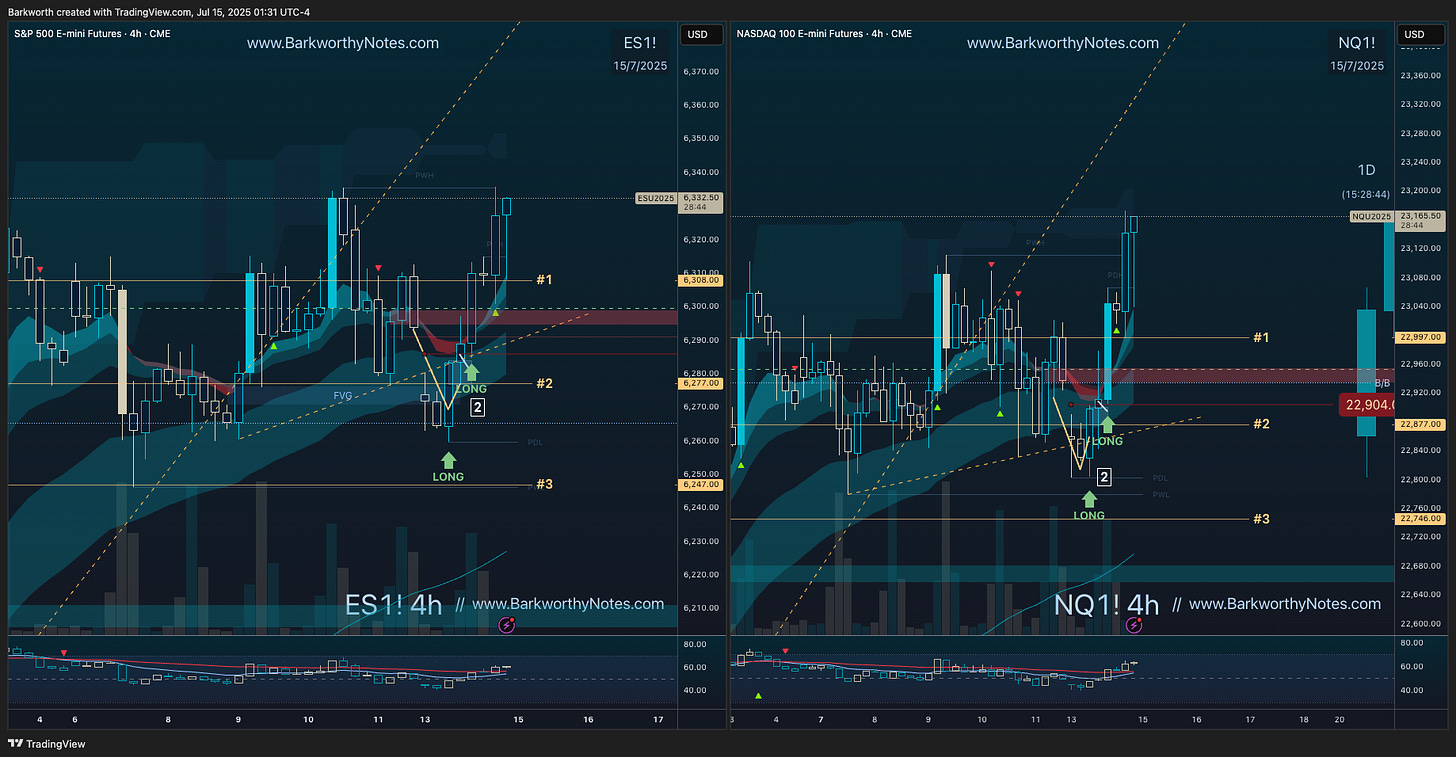

#ES_F / #NQ_F Trade Plan July 15

Mastering the S&P500 and Nasdaq 100 futures with Barky's Three Level Trade Plans

Daily Chart Update

I had two alternatives for yesterday’s session and markets chose path number 2, to wait for price to dip below the proposed 4 hourly breakdown diagonal and look for failed breakdowns to buy. This worked perfectly, with the London session giving an A+ reversal (recapped in today’s newsletter) and two solid break out adds into the US session. A truly epic start of the week for us.

Plan result: 73 points $ES_F and 356 points $NQ_F. These trades are recapped in today’s educational section.

Failed breakdowns lead to break out attempts and vice versa. We had ‘inside breakdowns’ fail yesterday, and the result was price looking above last week’s highs, with D1 EMA9 pushing price out of the range and through the key break out level I proposed.

Break out attempts today.

Today is make or break. Coming from ‘inside breakdowns’, the current push still only qualifies as a ‘look above’ and the keen eye will spot the persistent weakness and four higher highs. Buyers have to follow through. Failing now potentially marks the high of week and targets D1 EMA21 on the first break down attempt.

Revised levels, trade plans, trade recaps, charts, key levels, and trade plan video with video trade reviews, all in today’s newsletter.

Table of Contents

This Week’s Plan and the Coming Session;

Plan - New Three Level Trade Plans for $ES_F and $NQ_F;

$VIX - Implied Volatility (Bonus);

Video - Trade Plan Video with Previous Session Trade Recaps;

Recap Charts - Previous Session Setup Charts and Education.

For methodology, follow this link: Barky’s Three Level Trade Plans

Three Diagonals Will Change Your Life

This Week’s Plan

Plan for the this week as published on July 13: This week's plan centres on an "outside week," but whether the market moves up or down remains uncertain. The daily EMA9 contractions are the critical factors to watch. Expect sellers to attempt a pullback as RSI divergence confirmed exhaustion. Pull backs are never guaranteed, and would initially be dips to buy, with monthly OpEx the coming week’s main event. These are daily EMA9 consolidations in strong uptrends, and they rarely fade without taking out the high at least one more time.

Key Trigger: Losing D1 EMA9 sparks pullbacks towards demand.

Pullback Targets: D1 EMA14 aligns weekly Trend Control Diagonals and the projected demand zones.

Break out supports: ES $6153 - NQ $22426

Key weekly supports: ES $5959 - NQ $21567

Plans for the Coming Session

We got the anticipated dips into D1 EMA14 and markets are attempting immediate continuation. If these continuation attempts fail, profit taking is likely to hit, with D1 EMA21 the first downside target, aligning perfectly with hourly demand zones (in green).

ACTIVATED: Bullish Setup: Long to attempt immediate continuation.

COMPLETE: Bearish Setup: Short to backtest D1 EMA14 for daily higher lows.

Bullish Reversal Triggers:

- failing to break and hold below last week’s lows signals failed breakdowns;

- failing to break and hold below Friday’s lows signals failed breakdowns.

Barky’s Three Level Trade Plans provide precise entries to navigate these setups.

Unlock Winning Trades for Just $12/Month!

Get Barky’s Three Level Trade Plans for ES and NQ, plus exclusive charts, precise levels, trade plan videos, and session recaps. Don’t miss this week’s breakout setups - subscribe now!