#ES_F / #NQ_F Trade Plan July 3

Mastering the S&P500 and Nasdaq 100 futures with Barky's Three Level Trade Plans

Table of Contents

Review - Previous Plan and Trade Results;

Charts - Updates of the Macro Setup and Structure;

Plan - New Three Level Trade Plans for $ES_F and $NQ_F;

$VIX - Implied Volatility (Bonus);

Video - Trade Plan Video with Previous Session Trade Recaps;

Recaps - Previous Session Recapped Setup Charts and Education.

For methodology, follow this link: Barky’s Three Level Trade Plans

Previous Session Review

I shared specific entry levels for the 4 hourly short entries that triggered during the European session. ES gave 12 points, NQ gave 101. The plan was to look for those shorts to trigger, then watch price flush towards Tuesday’s low of day and look for long setups there. It worked perfectly, and we got textbook Diagonal Entry Models to give snipers during US pre-market and long at open.

The system gave:

ES 37 points long;

NQ 175 points long.

New and updated Three Level Trade Plans every single day - and my levels are fluid, not fixed. It allows for risk adjusted position management: big size, small risk. All explained in the first three articles of my trading course. Link in bio.

Chart Updates

Every day an overview of the higher timeframe setup and structure with the Three Level Trade Plans for the coming session updated and incorporated to offer a better understanding of the location and function of each of these levels.

A subscription is just $12 a month, where you will receive daily updated Three Level Trade plans with video AND detailed recaps from the previous day’s trades, as well as full access to my entire trading course…

Three Diagonals Will Change Your Life

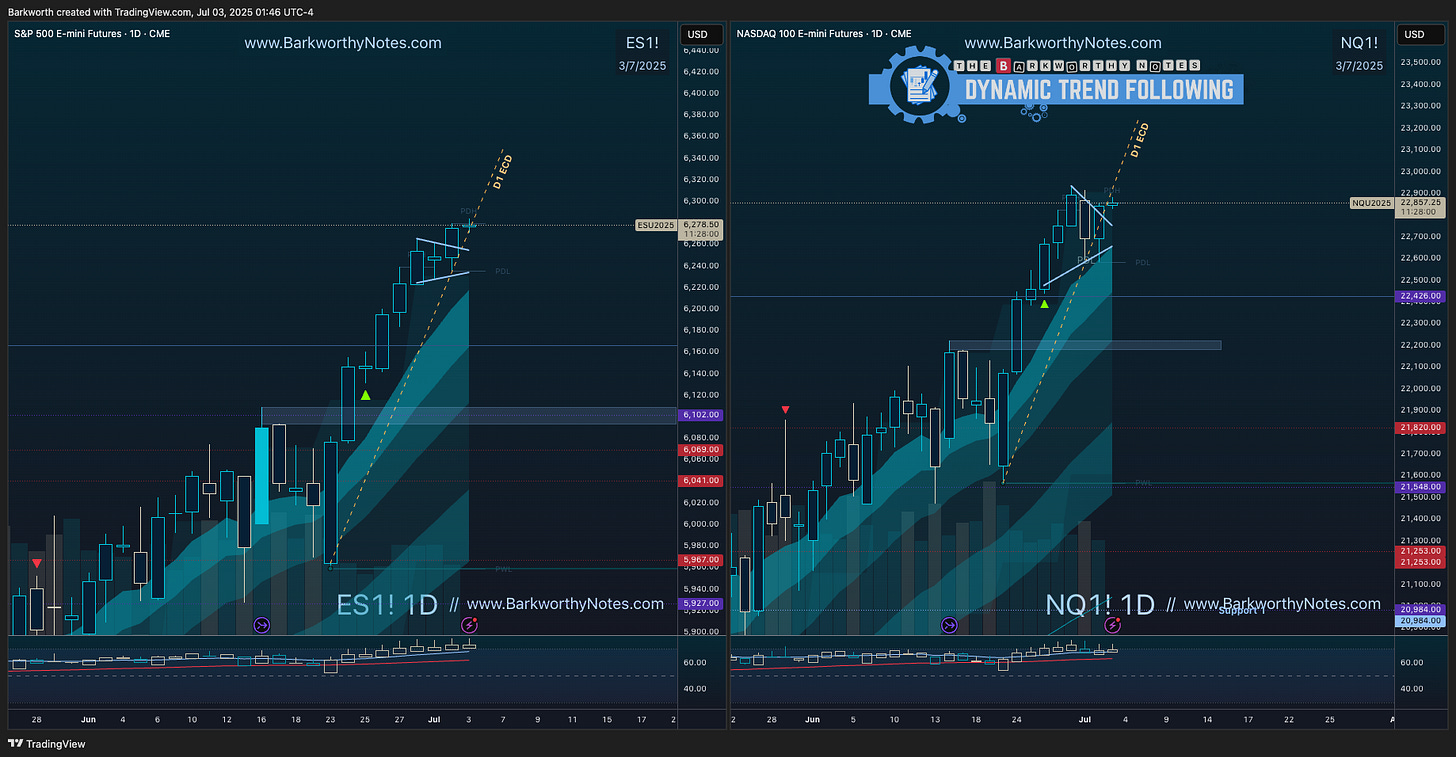

D1 - Daily chart update

Tech weakness persists as ES makes a higher high while NQ makes a lower high. Yesterday I proposed that we should expect D1 EMA9 to attempt to lead price higher - this worked. NQ now has to take out the high to confirm the higher low. This is because a higher low that fails to make a new high becomes a failed swing. Eye on jobless claims, unemployment rate and non farm payrolls today as we set up for the weekend.

For today, we have to stay on the 4 hourly chart, where NQ is ready to trigger short while buyers have one final shot at a higher low to set up the break out, and ES has to backtest H4 EMA9 and confirm the break out. Backtests are higher lows. If these backtests fail to make new highs, sellers take control and will attempt to target level 3.

Updated Three Level Trade Plans for the coming session in today’s newsletter. Subscribe for charts, levels, trade plan, trade plan video AND video trade recaps.