#ES_F / #NQ_F Trade Plan July 4

Mastering the S&P500 and Nasdaq 100 futures with Barky's Three Level Trade Plans

Table of Contents

Review - Previous Plan and Trade Results;

Charts - Updates of the Macro Setup and Structure;

Plan - New Three Level Trade Plans for $ES_F and $NQ_F;

$VIX - Implied Volatility (Bonus);

Video - Trade Plan Video with Previous Session Trade Recaps;

Recaps - Previous Session Recapped Setup Charts and Education.

For methodology, follow this link: Barky’s Three Level Trade Plans

Previous Session Review

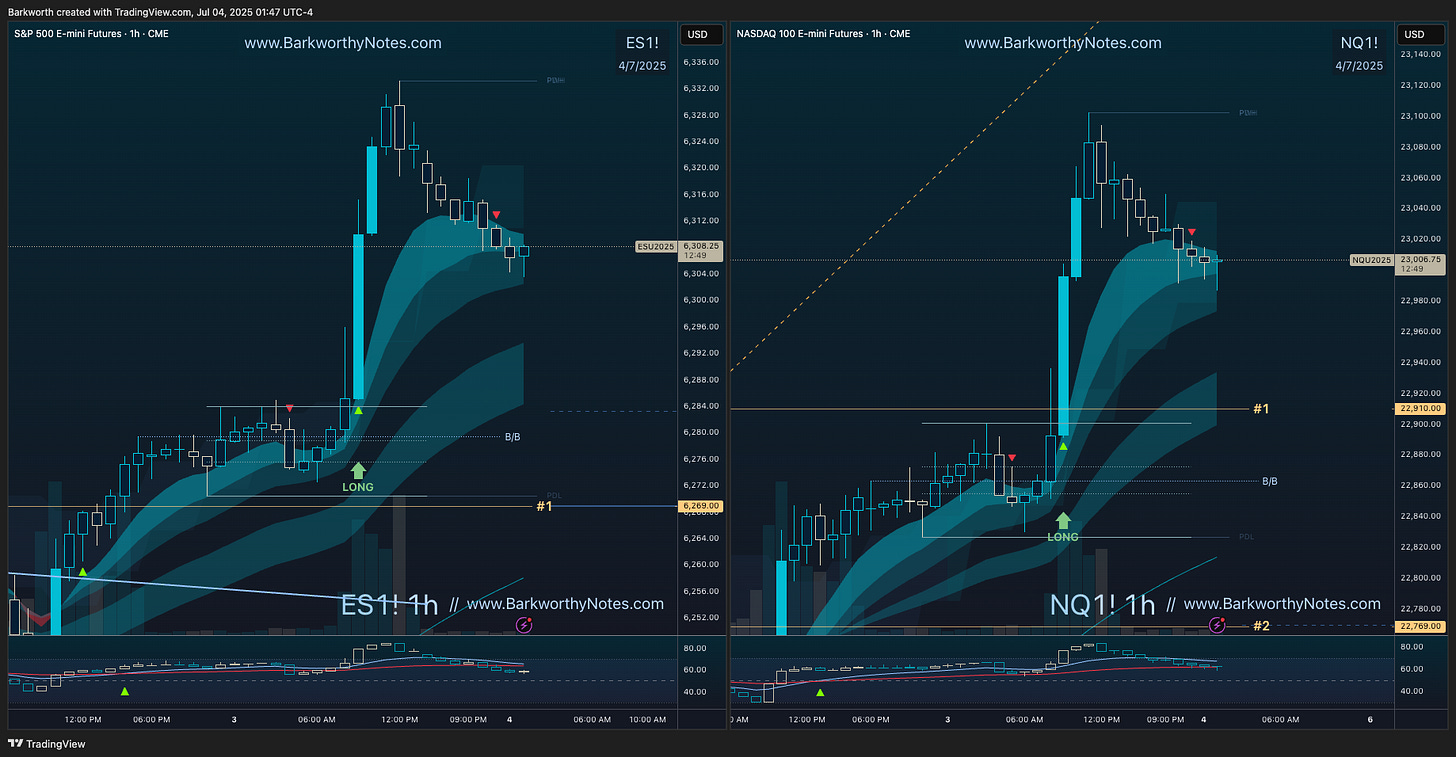

For yesterday’s session, I instructed readers to stay on the 4 hourly chart and look for a backtest of the EMA9 to confirm the break out, with the projected level 1 key for both. The majority of traders trailed from Wednesday’s failed breakdown, but the keen DTF/DEM trader caught the break out just 10 minutes after the US open.

Trade plan results:

ES 46 points long;

NQ 205 points long.

The hourly set it up: look above an exhaustion high, made a higher low towards a previous higher low, then pushed for a new higher high, backtested and never looked back.

Chart Updates

Every day an overview of the higher timeframe setup and structure with the Three Level Trade Plans for the coming session updated and incorporated to offer a better understanding of the location and function of each of these levels.

A subscription is just $12 a month, where you will receive daily updated Three Level Trade plans with video AND detailed recaps from the previous day’s trades, as well as full access to my entire trading course…

Three Diagonals Will Change Your Life

Stock Market Closed Today

For futures traders, here is a short update of the ongoing trade plan, three new levels for the session ahead, and a video to recap yesterday’s opportunities.

First, here are the setup charts that produced yesterday’s points. The opening break outs were tough to spot and trade as they were third higher highs extending on immediate squeezes without a single higher low, but they did set up in line with the system’s parameters.

Let’s have a look. Here are ES and NQ: