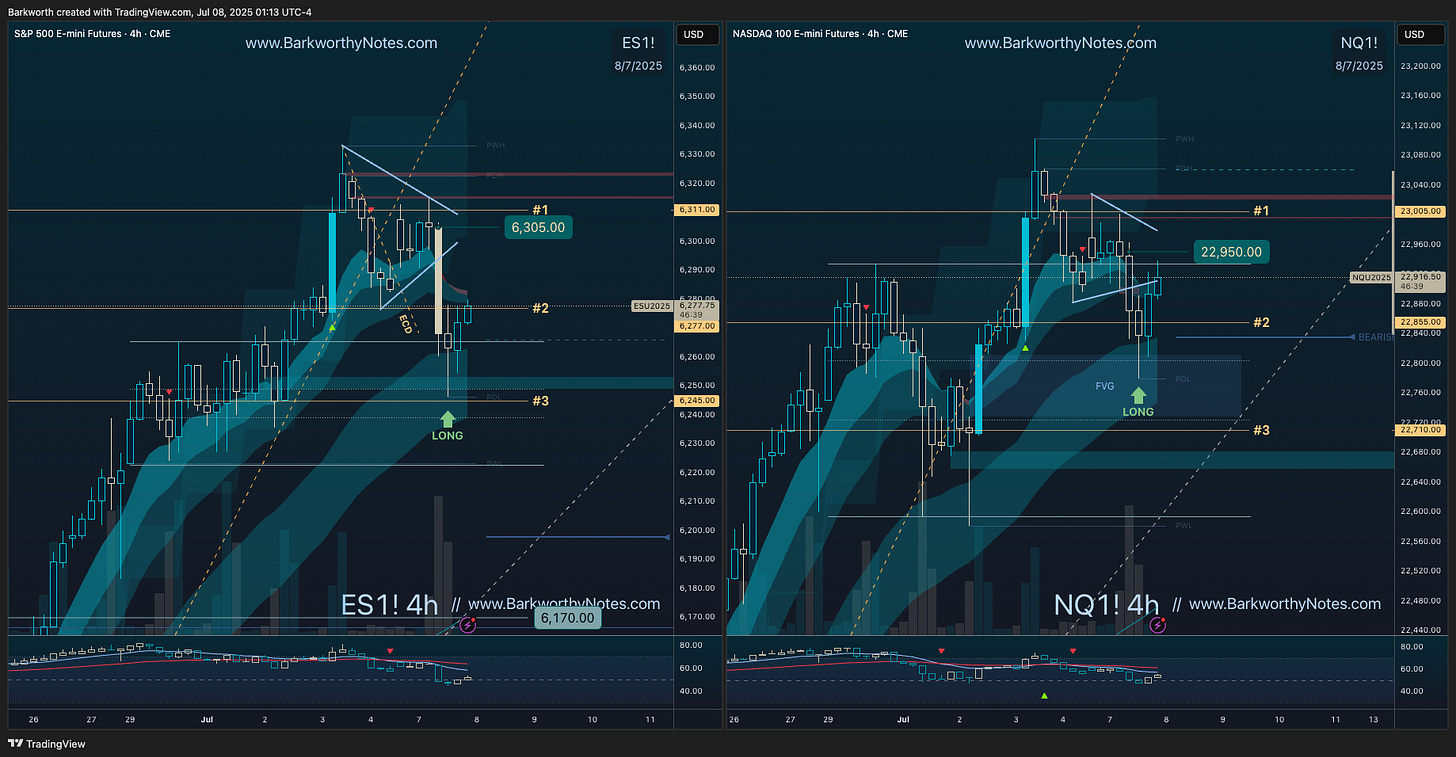

#ES_F / #NQ_F Trade Plan July 8

Navigating the S&P500 and Nasdaq 100 futures with Barky's Three Level Trade Plans

Note from Barky

Yesterday’s session produced the planned trade entries, with the Asian session gapping up through the given long triggers and the European session giving entries on the backtest and reached level 1 upside targets. Rejection there as planned, and buyers attempted to step in towards the US open, but these longs did not follow through, although they paid 2R for scalpers and 6R for those that left runners. Tariff news had sellers test level 2 and dip below, with our reversal setup forming at the projected demand zones for solid pushed back to yesterday’s chop ranges.

Plan result: 30 points for $ES_F, 138 points $NQ_F.

Yesterday’s higher lows now have to produce new highs, otherwise sellers take control.

Get the levels and plans to trade today’s price action with sharp risk insight.

Table of Contents

Charts - Updates of This Week’s Trade Plan;

Plan - New Three Level Trade Plans for $ES_F and $NQ_F;

$VIX - Implied Volatility (Bonus);

Video - Trade Plan Video with Previous Session Trade Recaps;

Recap Charts - Previous Session Setup Charts and Education.

For methodology, follow this link: Barky’s Three Level Trade Plans

Three Diagonals Will Change Your Life

This Week’s Plan

The plan for this week as published on July 6 is to expect consolidation and a potential pullback as price was climbing on fading volume and RSI weakness, signalling potential exhaustion.

Key Trigger: Losing D1 EMA9 sparks consolidations or pullbacks.

Pullback Targets: D1 EMA21 aligns with our new weekly Trend Control Diagonals (see W1 update above).

Break out supports: ES $6153 - NQ $22426

Key weekly supports: ES $5959 - NQ $21567

Update

I was looking for higher lows towards D1 EMA9 for both indices, and yesterday’s 4 hourly trade plan set it up perfectly. For today, this means that buyers have to reclaim the 4 hourly EMA9 to get back to yesterday’s breakdown zones, then hold above it to trend back to the highs.

There is a lot of unfinished business at the highs, and this kind of setup tends to take out the high before failing and reversing. Regardless of that expectation, yesterday’s low of day and last week’s low are key for the coming session, and aligned with the daily EMA9/14 cloud - readers know that below the EMA14, there is a high probability of the EMA9 pushing price through to the 21 and potentially lower.

We should technically expect to spend more time forming a range. Taking out the high and failing triggers hard short, while grinding lower forms hourly flag patterns and builds energy for the next big leg higher.

Plans for the Coming Session

Daily turns are best managed on the 4 hourly chart. Both indices are ready to trigger long to sweep last week’s highs, or short to backtest H4 EMA50 for higher lows.

Bullish Setup: Long to reclaim H4 EMA9 and sweep last week’s highs (ES $6333, NQ $23100).

Bearish Setup: Reject at these lower high to sweep last week’s lows (ES Short $6223, NQ $22581).

Reversal Triggers:

- failing to hold last week’s highs signals failed breakouts;

- no new highs after H4 EMA50 backtests signals failed swings (activated today).

Barky’s Three Level Trade Plans provide precise entries to navigate these setups.

Unlock Winning Trades for Just $12/Month!

Get Barky’s Three Level Trade Plans for ES and NQ, plus exclusive charts, precise levels, trade plan videos, and session recaps. Don’t miss this week’s breakout setups - subscribe now!