#ES_F / #NQ_F Trade Plan June 18

Mastering the S&P500 and Nasdaq 100 futures with Barky's Three Level Trade Plans

Table of Contents

Previous Day Trade Plan Review;

Chart Updates and Trend Status;

Updated Trade Plans for $ES_F and $NQ_F for the session ahead;

$ES_F Three Level Trade Plan;

$NQ_F Three Level Trade Plan;

$VIX Chart and Levels;

Video Trade Plan - a 15 Minute Trade Plan Explanation;

Education and Previous Session Trades Reviewed;

Methodology.

Here is everything you need to succeed in today’s market!

Session Review

Hourly failed breakdowns late into the European session and before the US pre-market started. We had a decent M2 Diagonal Entry Model into the US open to add back, after which we were looking for the hourly to confirm an uptrend, and when that failed, I closed the screen in anticipation of FOMC today.

The system gave:

ES: 33 points long;

NQ: 114 points long.

Every day new levels, then the same setup, same concept, same execution. Such is the advantage of a repeatable strategy, a framework for consistent risk management.

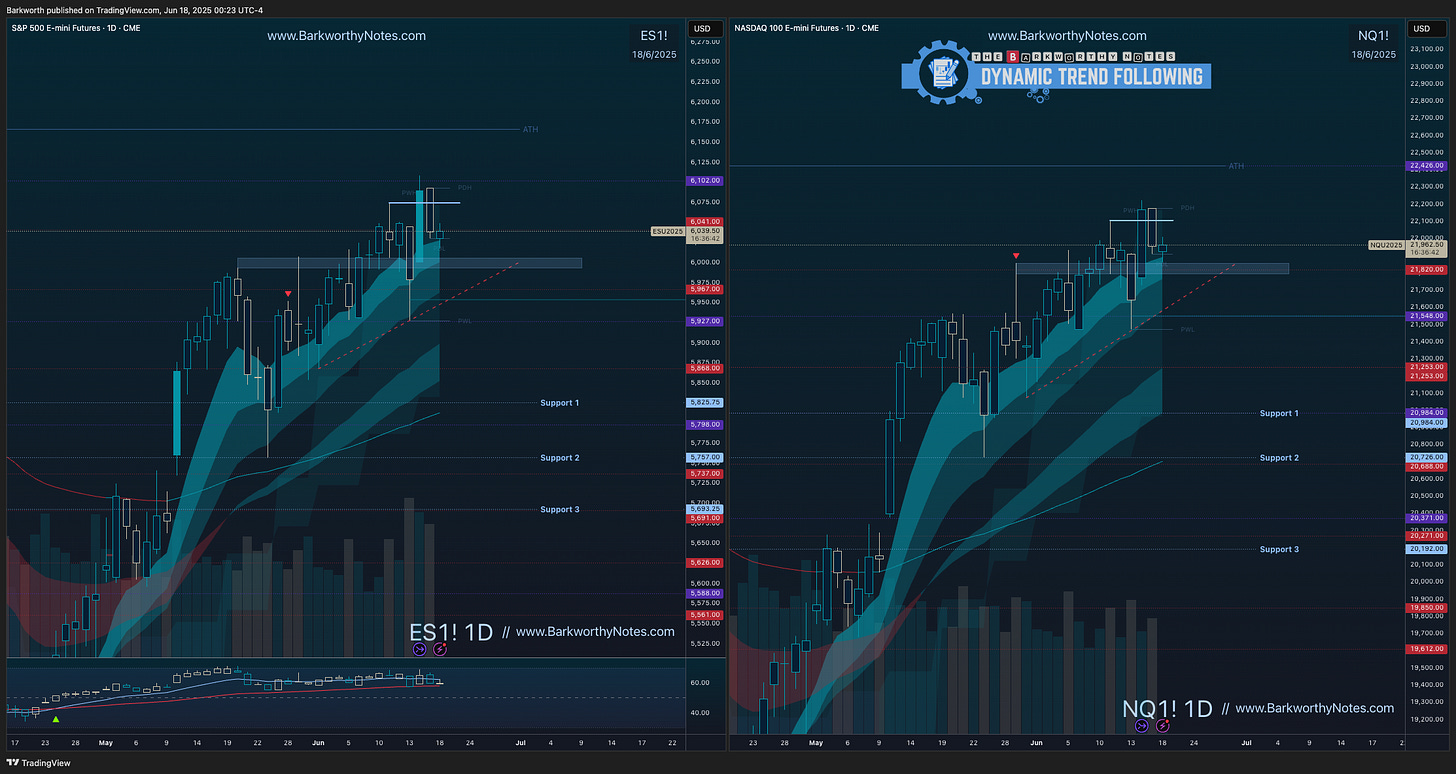

D1 - Daily chart update

Yesterday’s primary plan was to look for longs into H1 EMA50 for an hourly break out. The long paid but ultimately failed to follow through. The secondary plan takes us into today as price has arrived at H4 EMA50.

Make or break.

Price is flagging on H4 - see trade plans for the session - and resting on D1 EMA9. There are calls for failed break outs, but we have higher highs and the current rejections are new higher lows until last week’s lows are lost. Below last week’s low is where failed break outs confirm. Into today, buyers are still in control.

When this uptrend finally ends, looking for longs into D1 EMA50 is my first priority.

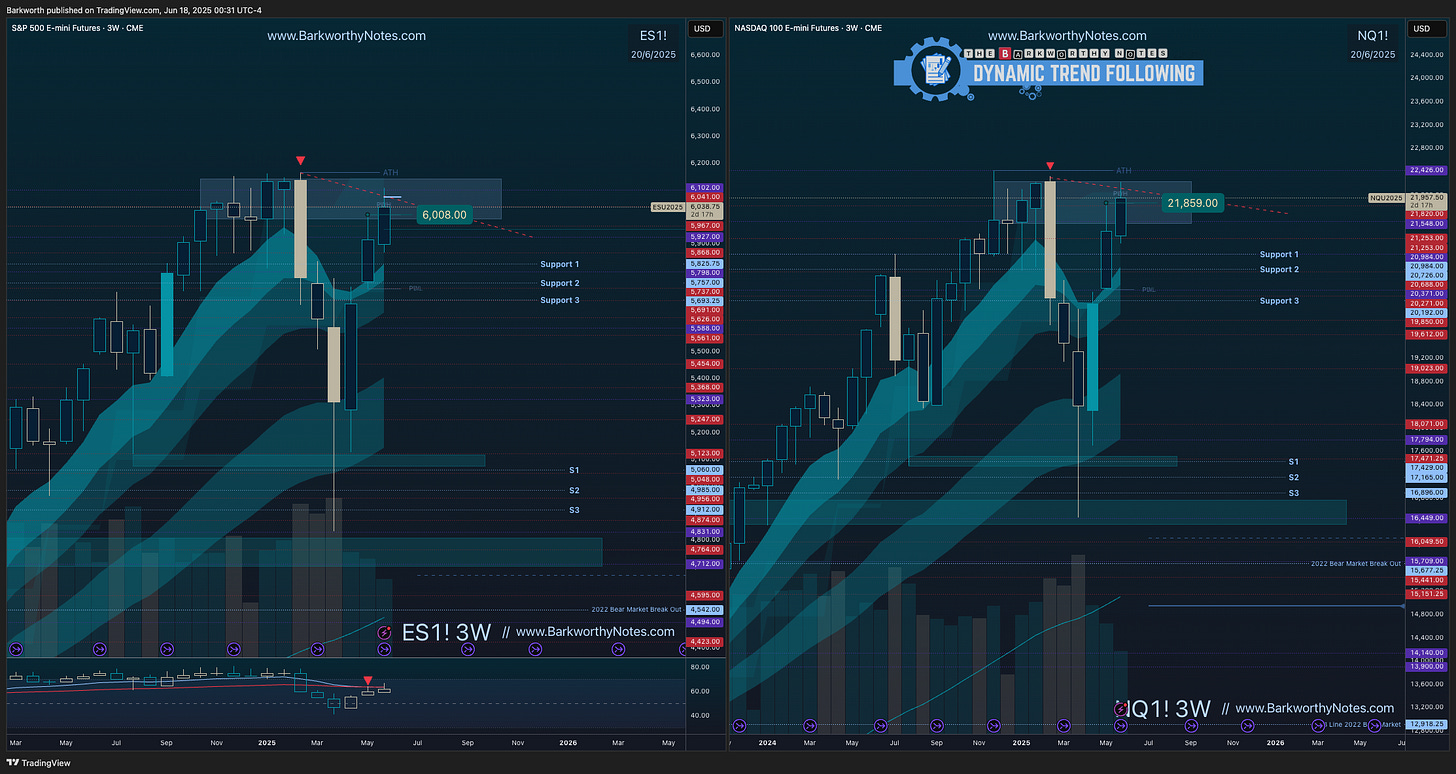

W1 - Weekly Chart Update

Buyers struggling with that supply zone we targeted last week.

W3 Chart Update

When price touches the weekly EMA21, it consistently aligns with the three week EMA9. W3 is highly effective for filtering macro trends. Updated daily, but only useful sometimes…

For the Coming Session

H4 is flagging, with the first zigzag complete and the structure wanting a lower high.

See trade plan charts and video for details, levels and instruction.