#ES_F / #NQ_F Trade Plan June 19

Mastering the S&P500 and Nasdaq 100 futures with Barky's Three Level Trade Plans

Table of Contents

Previous Day Trade Plan Review;

Chart Updates and Trend Status;

Updated Trade Plans for $ES_F and $NQ_F for the session ahead;

$ES_F Three Level Trade Plan;

$NQ_F Three Level Trade Plan;

$VIX Chart and Levels;

Video Trade Plan - a 15 Minute Trade Plan Explanation;

Education and Previous Session Trades Reviewed;

Methodology.

Here is everything you need to succeed in today’s market!

Session Review

To me, FOMC day means trade the open if there is a setup and then walk away. There was a decent long during the EU session, when price reclaimed level 3 and set up continuation towards level 2. Then the US open gave an attempt to get to level 1, which we expected would reject because markets tend to base into FOMC, so we scalped that and made what we needed for the day.

The system gave:

ES: 25 points long;

NQ: 86 points long.

Every day new levels, then the same setup, same concept, same execution. Such is the advantage of a repeatable strategy, a framework for consistent risk management.

D1 - Daily chart update

Yesterday’s plan explained the flag structure that was forming and I explained how we needed a lower high and another lower low to complete the structure. We took long the search for that lower high, with the overnight grind lower completing the pattern.

The structure is full of different patterns, but the most important is that buyers are consolidating above resistance and holding D1 EMA9. The H4 flag has to resolve higher, and if it does, the all time highs are the immediate target.

Price is still flagging on H4 - see trade plans for the session - and resting on D1 EMA9. There are calls for failed break outs, but we have higher highs and the current rejections are new higher lows until last week’s lows are lost. Below last week’s low is where failed break outs confirm. Into today, buyers are still in control.

When this uptrend finally ends, looking for longs into D1 EMA50 is my first priority.

W1 - Weekly Chart Update

Buyers struggling with that supply zone we targeted last week.

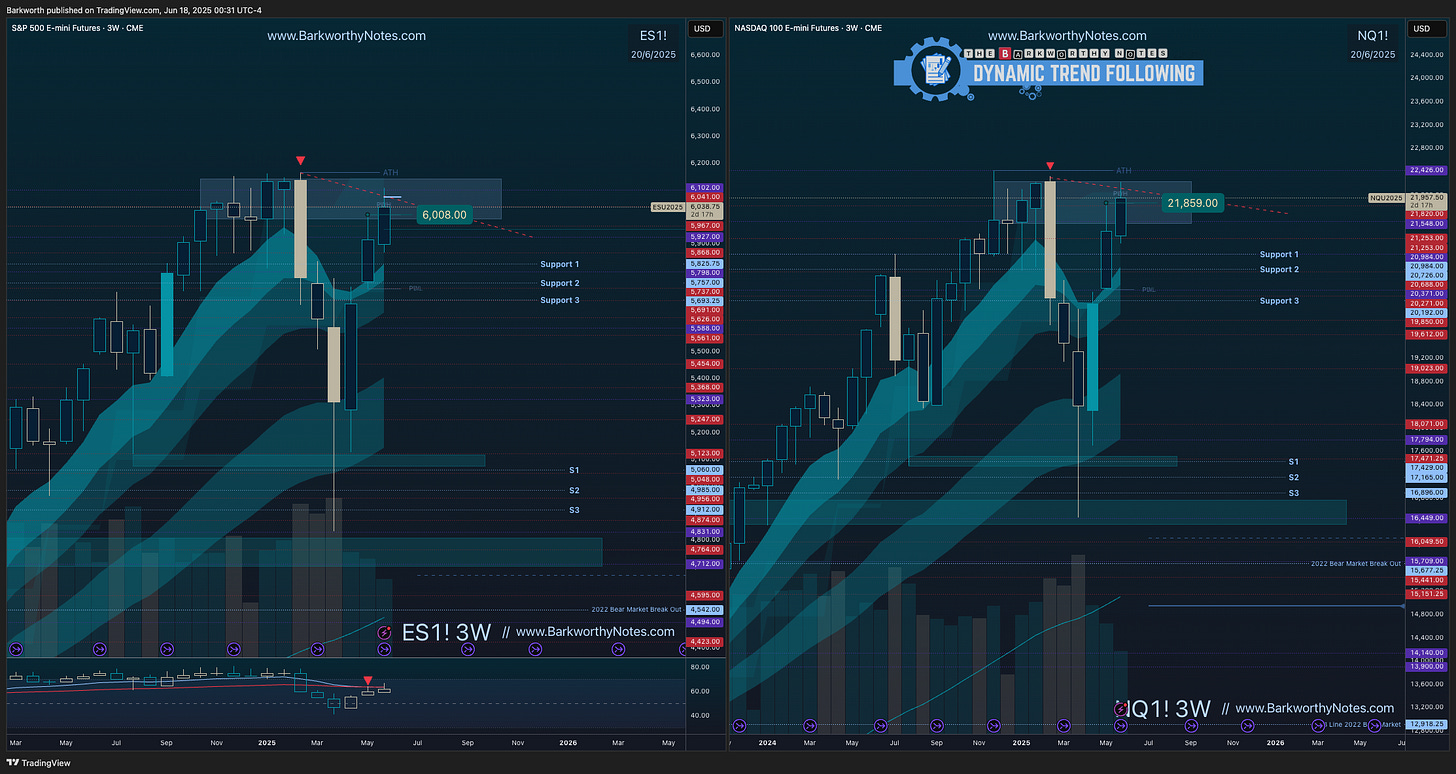

W3 Chart Update

When price touches the weekly EMA21, it consistently aligns with the three week EMA9. W3 is highly effective for filtering macro trends. Updated daily, but only useful sometimes…

For the Coming Session

Daily failed break outs confirm below ES $5927 and NQ $21470.

Mature H4 flags above resistance: the daily is ready for that push. Make or break!

Flags can break down, easily. It is up to buyers to reclaim H4 EMA9 and establish the hourly uptrend that is required to achieve the break out. We have a detailed instruction on flag patterns in the trading course, find the article here:

See trade plan charts and video for details, levels and instruction.