#ES_F / #NQ_F Trade Plan June 20

Mastering the S&P500 and Nasdaq 100 futures with Barky's Three Level Trade Plans

Table of Contents

Previous Day Trade Plan Review;

Chart Updates and Trend Status;

Updated Trade Plans for $ES_F and $NQ_F for the session ahead;

$ES_F Three Level Trade Plan;

$NQ_F Three Level Trade Plan;

$VIX Chart and Levels;

Video Trade Plan - a 15 Minute Trade Plan Explanation;

Education and Previous Session Trades Reviewed;

Methodology.

Here is everything you need to succeed in today’s market!

Session Review

The plan said H4 Flags, the instruction was to look for the break down attempt and get long when it reclaims. Late day, both indices closed the bull gaps and gave simple lower time Diagonal Entry Models, then M10 Continuation Models to add.

The system gave:

ES: 51 points long and counting;

NQ: 234 points long and counting.

Notice how the reclaim of level 3 was key. New and updated Three Level Trade Plans every single day - and my levels are fluid, not fixed. It allows for risk adjusted position management: big size, small risk. All explained in the first three articles of my trading course. Link in bio.

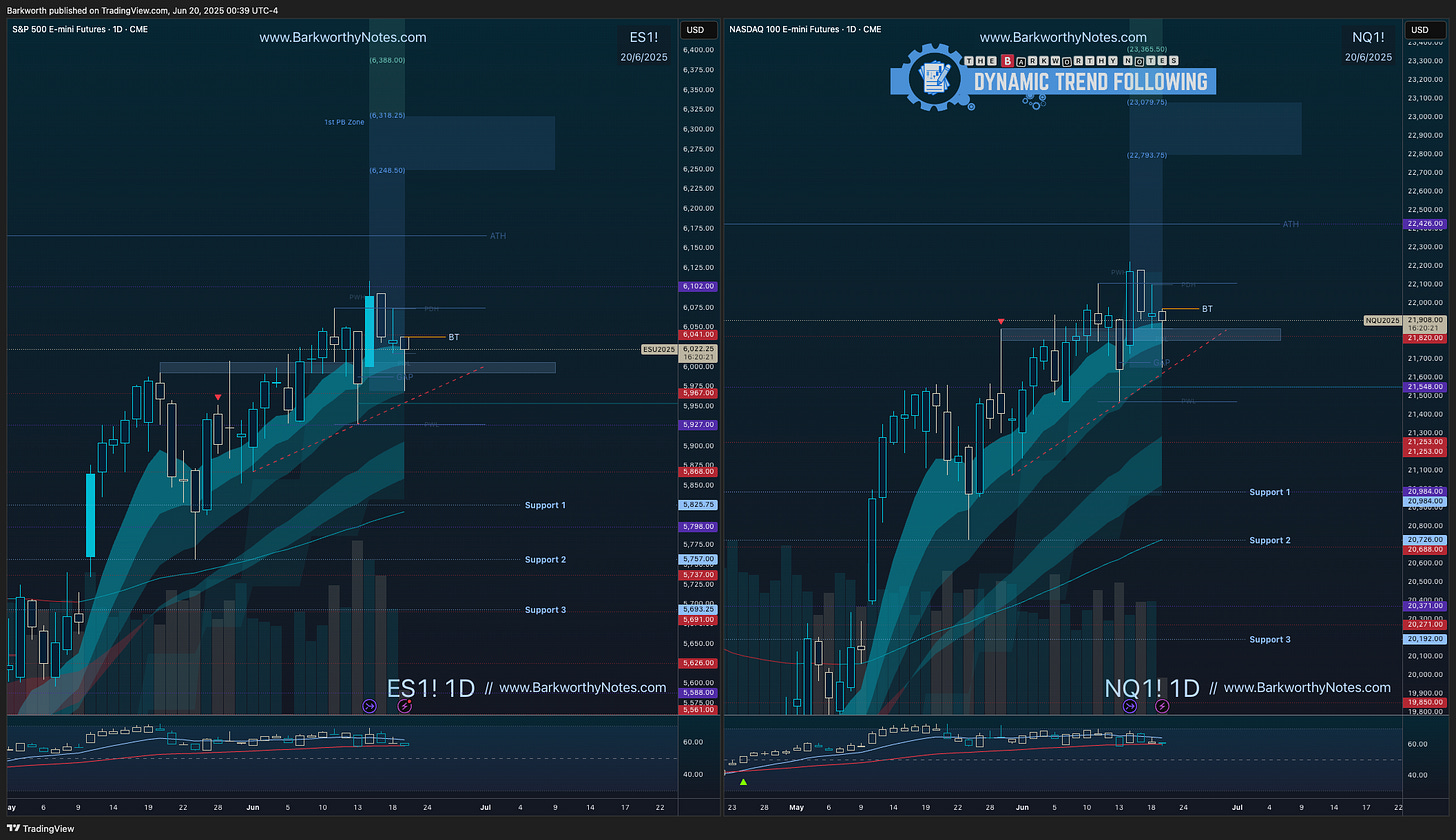

D1 - Daily chart update

The first stage of my H4 flags has played out as planned and in line with the instruction I shared yesterday - the trading course has a flag pattern instruction with details on the standardised way to trade them.

Sellers closed the bull gaps and tested D1 EMA21. This pullback marks the final chance for buyers to break out. If D1 EMA21 is lost, it would confirm that markets are likely to remain sideways into July, but as long as ES $5927 and NQ $21470 hold, the uptrend structure remains intact.

Opex today, but the setup is clear.

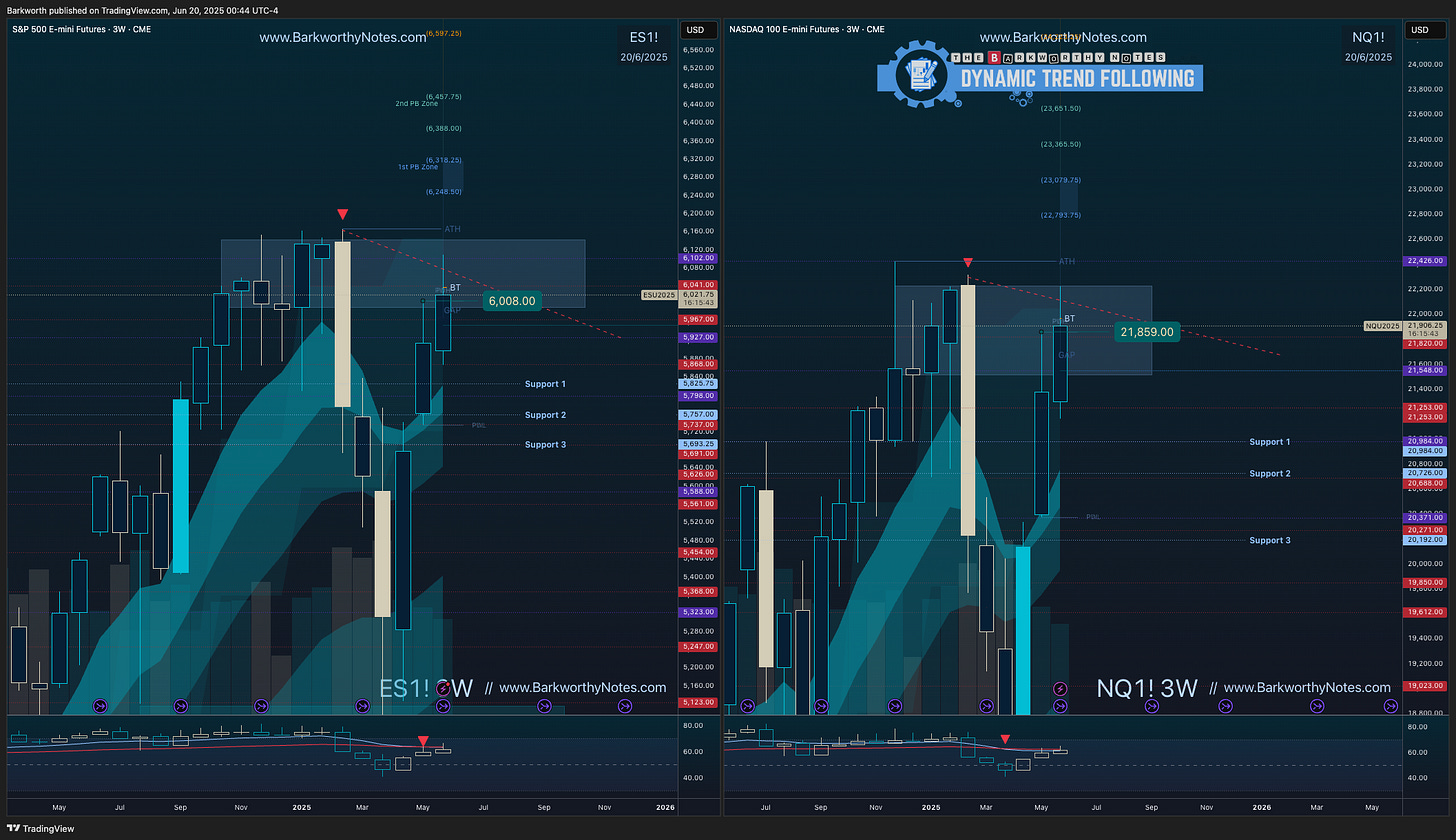

W1 - Weekly Chart Update

I have planned my long. You have to be ready, because it just might trigger.

W3 Chart Update

When price touches the weekly EMA21, it consistently aligns with the three week EMA9. W3 is highly effective for filtering macro trends. Updated daily, but only useful sometimes…

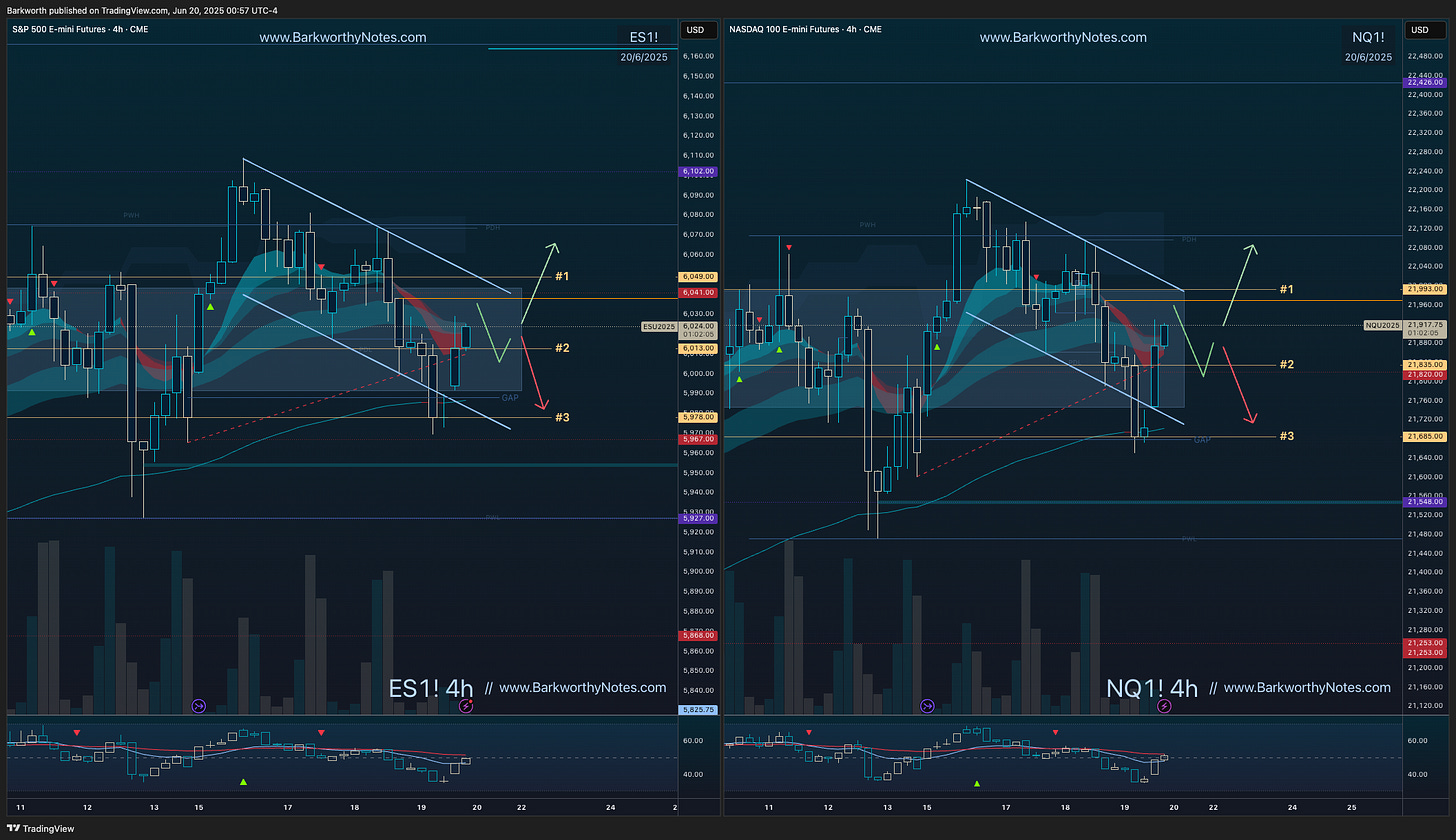

For the Coming Session

H4 Flags phase 2.

Daily failed break outs confirm below ES $5927 and NQ $21470.

Mature H4 flags above resistance: the daily is ready for that push. Make or break!

Flags can break down, easily.

Buyers reclaimed H4 EMA9 and have to confirm lower highs. From there we can adjust level 1, because acceptance above the lower high breaks out the flag. In the Bark World, this setup is called a Higher Low ‘n Go!

We have a detailed instruction on flag patterns in the trading course, find the article here:

Todays updated three Level Trade Plans set it up! See trade plan charts and video for details, levels and instruction.