#ES_F / #NQ_F Trade Plan June 5

Mastering the S&P500 and Nasdaq 100 futures with Barky's Three Level Trade Plans

Table of Contents

Previous Day Trade Plan Review;

Chart Updates and Trend Status;

Updated Trade Plans for $ES_F and $NQ_F for the session ahead;

$ES_F Three Level Trade Plan;

$NQ_F Three Level Trade Plan;

$VIX Chart and Levels;

Video Trade Plan - a 15 Minute Trade Plan Explanation;

Education and Previous Session Trades Reviewed;

Methodology.

Here is everything you need to succeed in today’s market!

Session Review

I wanted to add to longs on dips towards the hourly EMA50 - we got range day and a tough chop session. I prepared the Discord on forehand that initial dips into level two would likely be more M1 hammer candles like we had seen many times over the past few days - but I wanted a solid consolidation to prove to me that we would actually try to push higher. There was a break out attempt about an hour into the session that got slapped down, and when that short hit higher lows relative to that opening bounce, that is where the day’s money wave set up.

ES: 18 points long;

NQ: 84 points long.

Just business as usual for us. Same setups, same concept, same execution. Such is the advantage of a repeatable strategy, a framework for consistent risk management.

Setups recapped in the educational section - again, look at the consistency of my Three Level Trade Plans.

D1 - Daily chart update

The proposed D1 EMA9 consolidation is holding, and structure remains bullish as long as price is holding above - market is waiting for a catalyst (Trump/Xi, jobs data, etc.) and the next move is going to be volatile. If higher directly from here, the all time highs are next, if lower, D1 EMA21 and D1 EMA50 for daily higher lows.

Structure becomes bearish only when D1 EMA50 is lost, but neutral if D1 EMA21 is lost.

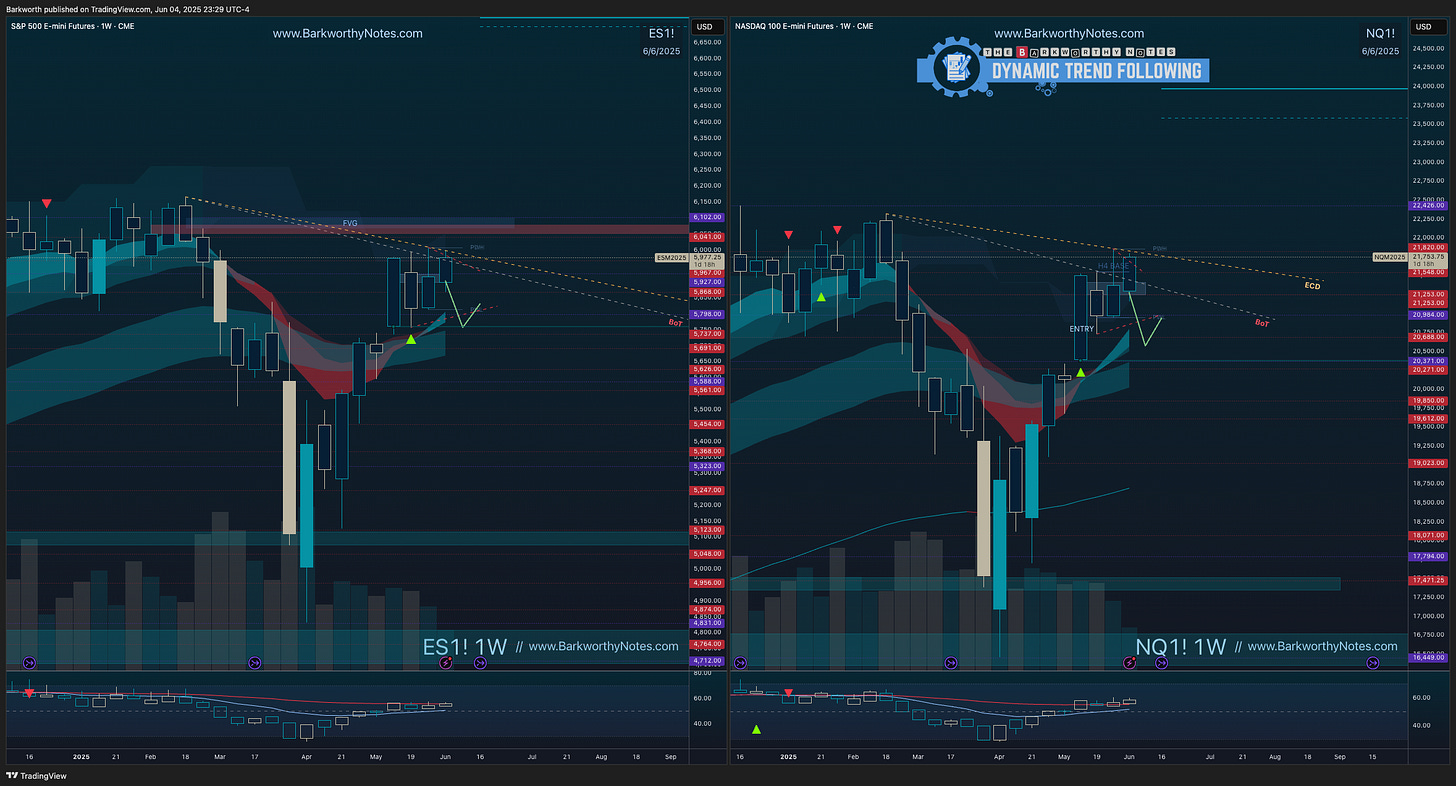

W1 - Weekly Chart Update

So far just an inside week.

If price seeks D1 EMA50, it will meet W1 EMA9 on the weekly chart for the first higher low since the April 8 reversal. If we get there, I want to buy an hourly bullish reversal with conviction at least the first time price hits it.

W3 Chart Update

When price touches the weekly EMA21, it consistently aligns with the three week EMA9. W3 is highly effective for filtering macro trends.

Markets are bullish above $ES_F $5759 and $NQ_F $20377.

For the Coming Session

Market is in a holding pattern, but consolidating above 4 hourly resistance, below daily resistance. We have more jobs data today and tomorrow but disappointing jobs reports are likely going to see investors speculate on rate cuts, and although they might not drive price higher, it remains to be seen if disappointing jobs reports are enough to finally drive real selling. Price leads, clearly, and for today, the setup still tells us to look for dips to buy.

Eyes on the financial sector XLF today/tomorrow - if it decides to trend, markets can target all time highs. Yesterday I wrote that markets are coiling for a massive move, but may coil for a few days more. Price is pushing into resistance and time is running out. If buyers don’t follow through on yesterday’s ‘look above’ and the overnight higher low, sellers take control and target the daily EMA9. Acceptance above yesterday’s high of day initiates the break higher.

Updated Three Level Trade Plans in today’s newsletter, with three key levels for precision risk management for both indices, along with my detailed setup analysis and trade plan video.