We have studied how price forms imbalances, and how imbalances together form balance zones. We’ve seen how imbalances can be traded against, drawing EMA Boxes, and we have understood how imbalances create higher lows and lower highs to give us our entry diagonals.

We’ve used the words “failed swing” and “failed break” here and there, and if you have come this far in the trading course, you should have a strong concept of what those kinds of ‘failed continuation’ mean, although you might still struggle with spotting them in real time.

Only Two Ways to Initiate a Reversal

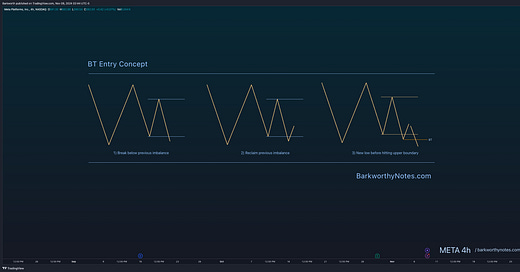

Price action truly only reverses in two ways: failed breaks (look below or above) and failed swings (higher low or lower high). There are no exceptions to this rule, which is why the RT and BT concepts are so powerful. If you can train yourself to spot failed breaks and their subsequent targets, you’ll understand the difference between an exit area, an entry, a failed swing and a failed break.

In reality, learning these concepts can be challenging, but since the principles are always the same, once you understand it, you start to see it everywhere, and can use it to make decisions when you are looking for an entry.

RT and BT concepts validate entry diagonals versus support or resistance diagonals. The question is always, “where is price coming from”, and therefore “is this diagonal break a failed swing, a reversal trigger, or simply a ‘look above or below’?“

The Concept behind a Failed Swing

The principle is extremely simple and repeats itself over time, with every single imbalance. We know how to draw our boxes, right? We take the latest pivots for the upper and lower boundary, and then wait to observe price.

Once we have a box, an imbalance, and price breaks above or below that, it is an attempt to break out. When price then returns back inside the box, it marks an attempt to maintain balance and targets the opposite boundary.

The negotiation between sellers and buyers usually forms a new imbalance that we like to call a break out consolidation, or a negotiation for acceptance. This is where the RT concepts come in.

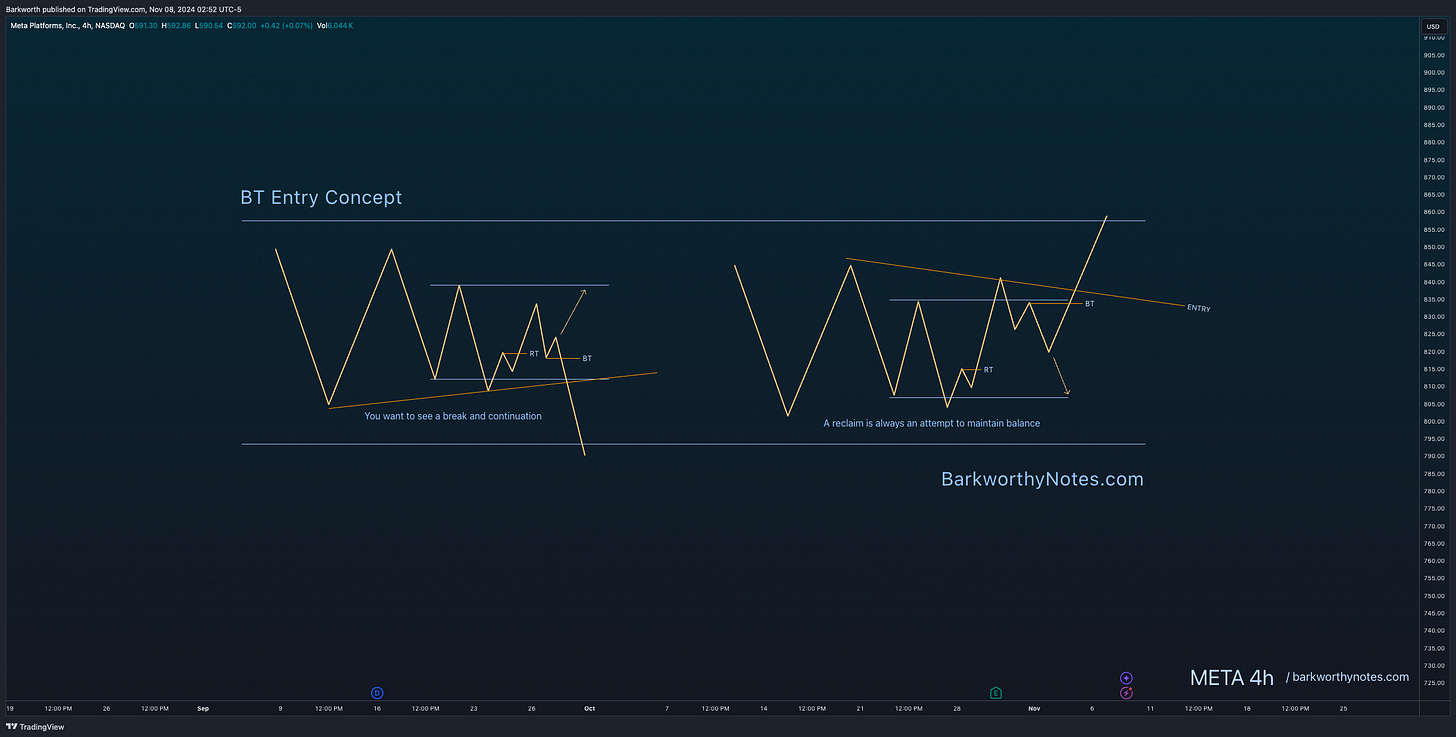

Sometimes price displaces immediately when the BT entry triggers, while other times, price consolidates for acceptance or rejection. The latter is how our Continuation Model forms.

It is important to understand that a balance zone is made up completely out of failed swings. In this diagram, you see a sideways consolidation into a trending EMA50 - so this is an EMA50 Box - with price attempting to push higher, but sold back down, attempting to flush, but bought back up. Each of these line to line moves is a failed swing.

The BT entry is the backtest entry. The concept depends on price to break a level and reclaim it, then lose it again to take out the high or low (long or short setup).

In simpler terms, it is a reversed failed break down. The BT entry is a failed break in. You see in the above example that price is being held in place. At the end, price breaks above it and then pulls back. That pullback is sellers’ attempt to maintain balance, to break price back into the range.

This concept is very powerful, because not every setup produces a decent entry diagonal. In this example, the BT concept was the only conviction entry: