Futures Trading - April 21 Plan

#ES_F and #NQ_F - Trading the S&P500 and Nasdaq 100 futures - Contextual analysis, setups, charts, detailed trade plans and recaps from the previous session to demonstrate my system.

Here is everything you need to succeed in today’s market!

S&P 500 and Nasdaq 100 Futures

$ES_F #ES_F $NQ_F #NQ_F $SPY $SPX $QQQ $NDX #Futures

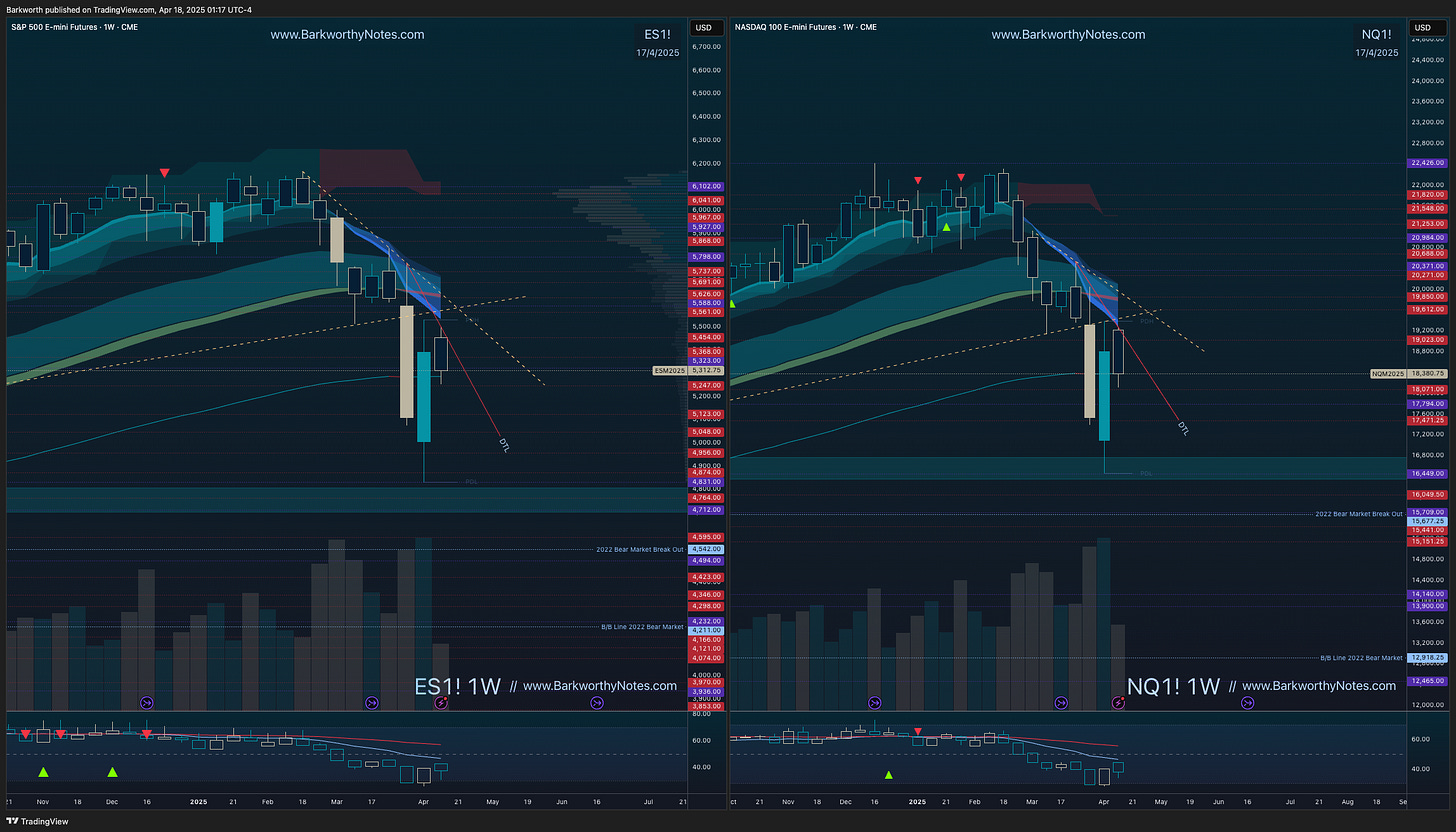

Yesterday’s trade plan result:

ES: 102 points from 4 setups;

NQ: 602 points from 6 trades.

Traded the H1 EMA Dance.

See attached chart with trade plan result, and notice the consistent accuracy of my levels as I update and change them every day to align with the hourly opportunities.

In yesterday’s video analysis, I expressed the hope that price would hold the range. It did, leaving us with perfect D1 EMA9/21 wedges, ready for directional breaks.

The plan for the week was to see W1 EMA9 rejection to produce daily higher lows. That worked, and sets up the plan for the coming week.

On D1 we now have EMA9 backtests after the EMA21 rejection, backtesting EMA9 for the push lower. If that fails, we trigger long. That is the plan for the coming session.

For the session ahead, things are really simple now. We have a daily setup. All we need is an attempt to break, then confirm or fail for us to participate in that break or the subsequent reversal. The hourly is setting it up, leaving us contracted with a lower high and a higher low into H1 EMA9 that has to reject.

In today’s newsletter we talk about this hourly setup versus the obvious H4 CMod = D1 DEM, and what has to happen to trigger a directional move. We have new Three Level Trade Plans to lead the way, along with video to narrate the trade plan, as well as detailed charts and recaps of yesterday’s opportunities and trades.

Read all about it: trade plans, recaps and video analysis in todays edition of the Barkworthy Notes.