Futures Trading - Feb 11 Plan

$ES_F and $NQ_F - Trading the S&P500 and Nasdaq 100 futures - Contextual analysis, setups, charts, detailed trade plans and recaps from the previous session to demonstrate my system.

Markets have been basing for a close to three months now, and all we have been doing is buy and sell H1 EMA9 Reversals. Break outs don’t work when there is no trend.

I did a short video to explain how base boxes have to be traded:

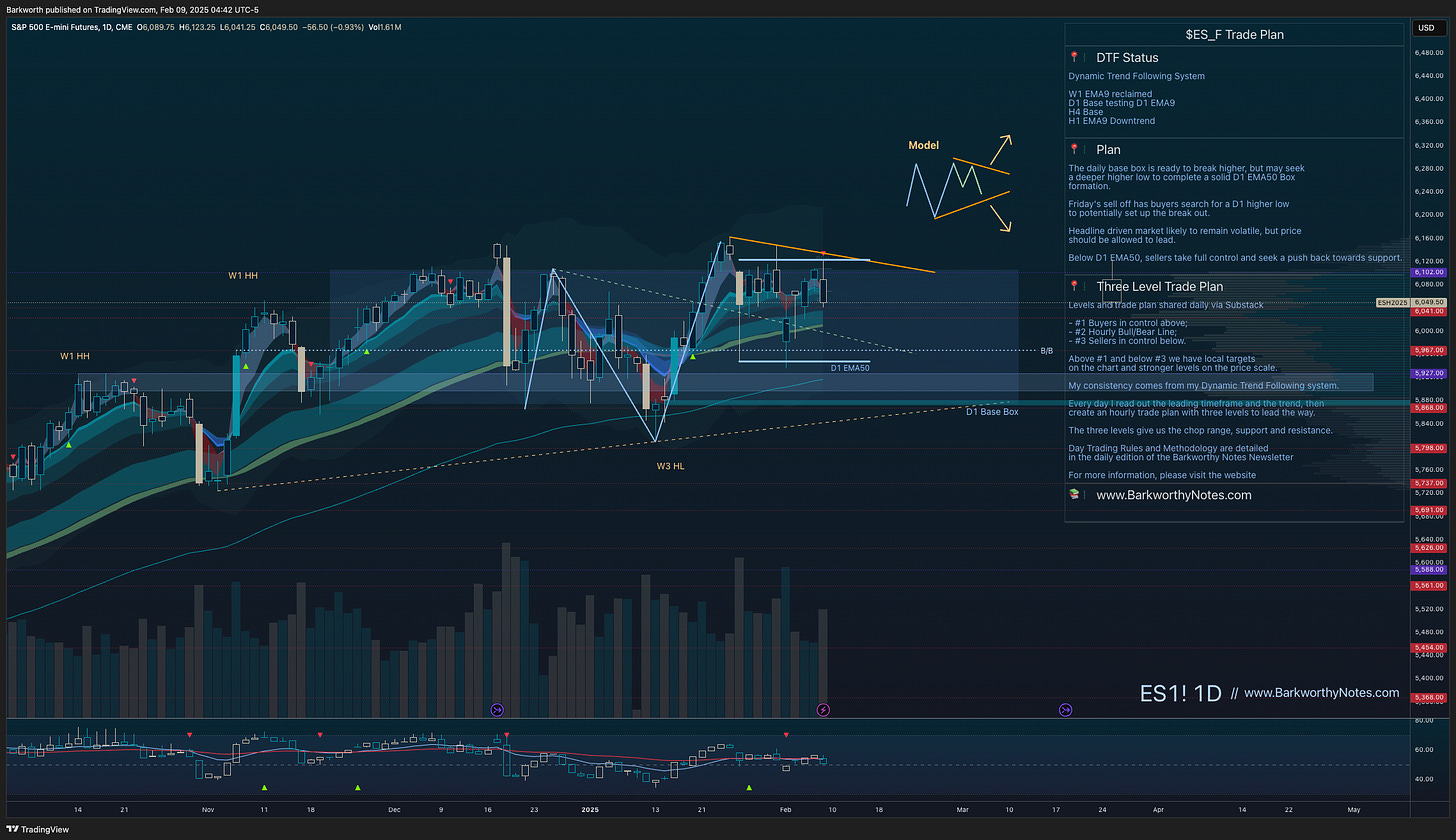

S&P 500 Futures

$ES_F $SPY $SPX #Futures #Stockmarket #DayTrading #Investing #sp500trading #futurestrading #MarketAnalysis #NQTrading #ESTrading #SPY #QQQ #RTY #DIA

📁_$ES_F // Yesterday’s Plan in Review

Yesterday’s plan gave 81 points, but only if you traded the Asian session.

Every day I send out a Three Level Trade Plan as a roadmap for the coming session. Here is a copy of yesterday’s plan. Trade recaps and journal were sent with yesterday’s closing update.

📁_$ES_F // For the Coming Session

I contrive my daily trade plan from my signature Dynamic Trend Following system, with the EMA Dance concept leading the way.

Strong demand at D1 EMA50 tells us the base is ready for a directional break.

Buyers reclaimed D1 EMA9 and attempting to hold. Break out in play as long as price holds D1 EMA9/14.

I keep buying H1 EMA9 reversals until an H1 EMA50 Box sets up. When I get that, I’ll buy the H1 EMA9 break out. When there is no trend, we have to buy EMA9 reversals. When there is a trend again, we can buy break outs. It it literally that simple.

Today’s Three Level Plan sets it up, here is the setup chart, detailed Three Level Trade Plan in today’s paid section.

Nasdaq 100 Futures

$NQ_F $QQQ $NDX #Futures #Stockmarket #DayTrading #Investing #sp500trading #futurestrading #MarketAnalysis #NQTrading #ESTrading #SPY #QQQ #RTY #DIA

📁_$NQ_F // Yesterday’s Plan in Review

435 points from the proposed dip into D1 EMA50. Gap down, reverse, easy trade, but only if you were awake to trade the Asian session. Regardless, this was the exact path I drew for the session’s PA.

Every day I send out a Three Level Trade Plan as a roadmap for the coming session. Here is a copy of yesterday’s plan. Trade recaps and journal were sent with yesterday’s closing update.

📁_$NQ_F // For the Coming Session

I contrive my daily trade plan from my signature Dynamic Trend Following system, with the EMA Dance concept leading the way.

Strong demand at D1 EMA50 tells us the base is ready for a directional break.

D1 EMA9 reclaimed and tech in the lead, finally. D1 EMA9 key today - break out attempt as long as price is above.

H4 EMA50 contraction sets it up, with an H1 EMA50 box attempting to form. A broad rotation back into tech would have the power to break out markets. Yesterday’s candle is key. Inside day for more contraction, above or below yesterday’s HOD/LOD marks the attempt to break away.

Confirmation of a daily higher low start with an H1 EMA9 reversal, and Three Level Plan sets it up, here is the setup chart, detailed Three Level Trade Plan in today’s paid section.

Live charts and plan updates in the Barkworthy Discord (additional subscription).

Tradingview

Don’t have a Tradingview subscription yet? Please use my referral link: https://www.tradingview.com/pricing/?share_your_love=Barkworth

Then copy My Chart Layout and Indicators: Copy Barky’s Setup.

Beginners

Study my risk management instructions. There is no room for enthusiasm in trading. If you are serious about this, you will standardise your risk per trade. Remember that patience is key. This is a marathon, not a sprint. Keep a steady pace, and don’t make exceptions. Most people blow their emotional capital because they are impatient. You can grow a $100 account into $1000 in just 10 to 20 trades, but the majority of traders can't do this because they are impatient and start taking too much risk, giving back gains from earlier trades and destroying their confidence. Focus on % not $.

Remember, in most ventures in our world the difference between success and failure is most often just the ability to push through. All of you are well on your way to achieve life changing goals.

Barky’s Three Level Trade Plan

The daily trade plan always offers a set of the most important levels and highlights three levels as key:

“1” marks the break out level for continuation higher. If level one is lost, short to level 2, and look for a higher low to buy the dip;

“2” marks the bull/bear line of the current price action. Bullish above, bearish below. Higher lows can be bought above level 2, lose and reclaim triggers long back to level 1, but when level 2 is lost, short towards level 3;

“3” marks the break down level and the final ‘lose and reclaim’ opportunity for buy

ers. Acceptance below confirms a bearish reversal and a downtrend.

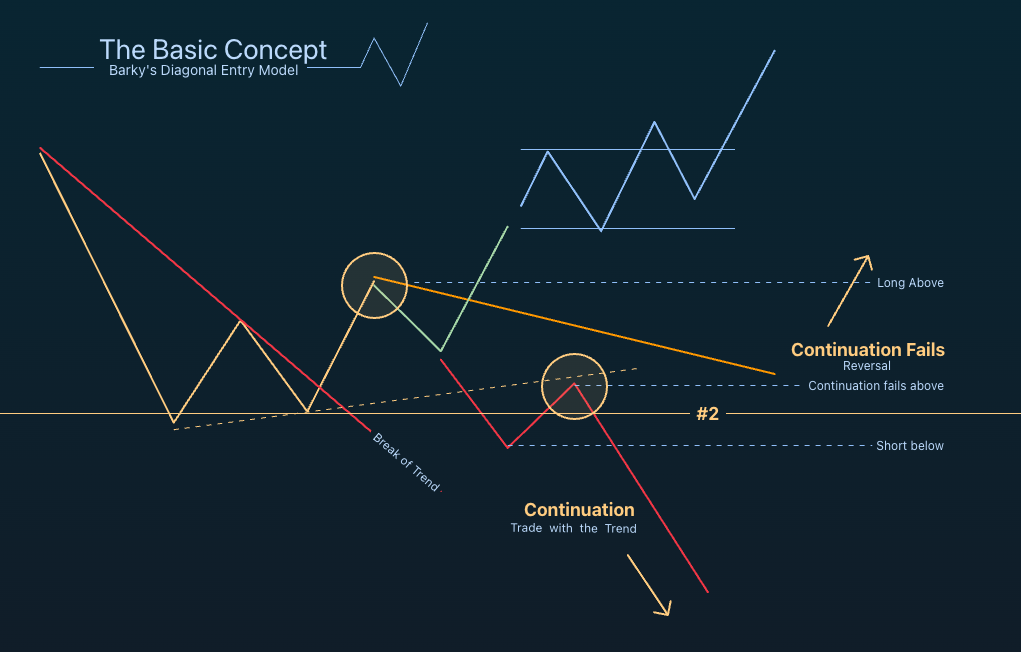

How to enter

Above or below a pre-planned level, price has to form an entry model.

Below is a basic diagram of the entry model concept. It always sets up the same way and once price looks below or above, we have what we need to define risk and consider participation.

The model is extremely consistent, always looks the same, no exceptions, and sets up several times every single day. To demonstrate the system’s consistency, I share charts and recaps of theses entries with my trade journal at the end of every session.

Read more about my methodology here:

Below follow Three Level Trade plans for the S&P 500 and Nasdaq futures.