While some of you may be experienced traders looking for stability, I am sure that many readers are also completely new to markets and have never heard of a psychological phenomenon that is generally known as ‘going full tilt’…

No matter how many traders I speak with, without exception, everybody has experienced it at least once, and everybody agrees that going full tilt is the weirdest thing.

Emotions versus ratio

Market psychology is simple human psychology. We have deeply rooted primal instincts that are designed to protect us. Money is directly linked to our survival needs and therefore has the potential to target us deep in our survival instincts - taking us by complete surprise if we are not prepared.

Market require us to do the opposite of what is natural to us. We need to cut losses immediately, and we need to give winning trades space to play out. Our natural instincts work against us, and have us lock in profits almost immediately when we are in a winning trade: protect those gains in order for us not to lose them. This same instinct tells use to let losers go with hopes to get back to break even.

As a result, without discipline and a risk information system, we get stuck in losing trades, having no problem to hold bags into deep and devastating red, while selling potential winners early, only to then chase it frantically with hopes to catch some of that scary uptrend.

The market challenges everybody this way, and most of us get blindsided by it, while others walk into this trap seemingly willingly.

We need awareness and preparation to understand and organise the chaos in our own minds. Markets confront us with ourselves in ways we never expected or at all thought possible.

Mental Preparation

Success as a trader happens twice. The first time when you discover a system, the second time inside your mind. We all get blindsided by market psychology and have to suffer through it. Suffering is the correct word, and for some of us it may even get so tough that you’ll start thinking that perhaps you don’t have what it takes.

My personal experience was exactly like this. I had designed a system and was doing so well. Great days, taking setups as they presented, and compounding gains. Care free, just seemingly unconditional success. I kept riding that wave until I suddenly took a loss. A simple, but full 1R loss. Something glitched in my head, and I somehow decided that this loss was unacceptable. I was almost immediately in a new trade - this time not a setup, and lost again, now 2R down and by the end of the session I had blown my account.

The above is how I discovered trading psychology, and I was lucky that I was trading my small beginners account. I started with just $1000 to practise and I had decided to trade it up to $3000 before I’d start scaling. I got to $2400, and ended with $1.18. Six months of work destroyed in a single day... Even today, I still don’t understand how I could have let that happen. All I had to do was walk away, but I couldn’t.

Here is why: I was unprepared!

Trading Psychology

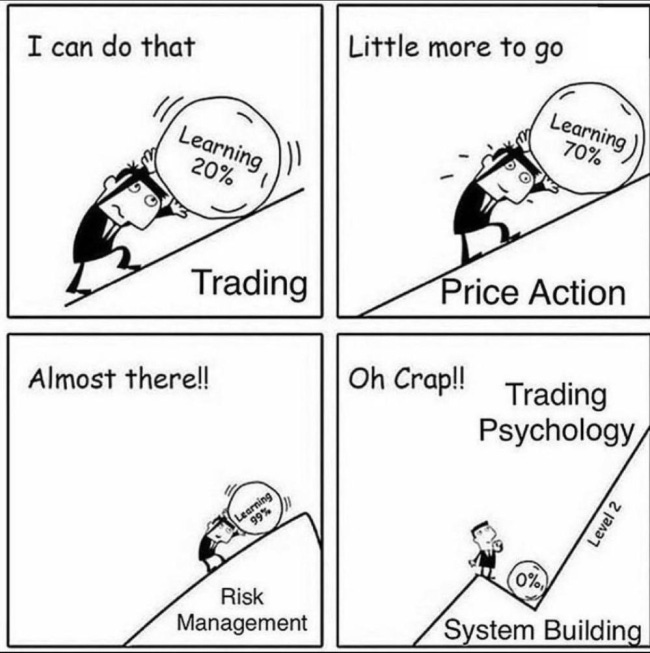

Until I blew my account, I had no idea that there was such a thing as trading psychology. I had read somewhere that markets require us to do the opposite of what we are thinking, but that was nothing to prepare me for what was about to happen. When I stumbled upon the following meme, I felt it explained the process so accurately:

As beginners, our trading plans are superseded by emotions and bias. This is where trading psychology becomes important. It refers to the mindset, including the emotions and feelings that we experience as we engage the market. We want a piece of everything, but we need a setup. Trading psychology looks into how you manage your emotions and decision making process.

The purpose of trading psychology is awareness. If you are aware of what can happen when you take a trade, being aware of the destructive nature of revenge trading, you can prepare yourself to stay balanced and follow your process instead of losing control.

Mental preparation is everything. When I plan a trade, I risk 1R. Even today, while I am making a generous living for myself and my family, I still go by the same process. My trick is this:

When I take a trade, I consider 1R lost - that is really it. I enter, and I think to myself “it’ll prolly not work - that money is likely lost, but if this one doesn’t work, the next one will” - and then repeat the same mind-trick with the next trade.

Because of preparation, a loss doesn’t affect me at all anymore. The trade didn't work? Fine. Part of the game. I made a mistake? Argh, idiot. 1R gone.

Patiently Stick with the System

My Anchor and Root Timeframe concepts tell me what I am supposed to do. My way of avoiding tilt and negative emotions all together is based on two simple rules:

Wait for a setup and then force myself to trade it in line with the rules (trust the system, don’t hesitate);

Take a break immediately when I take a loss - and stay away for at least an hour, then get back to waiting, not trading.

Remarkably, and I'm sure that many relate to this, this was the hardest thing I ever did in my life. So then I framed the M10 Anchor timeframe rules as best as I could, and offered it to this trade as "specific patience parameters", telling them that their job would be to only wait for it to set up this way.

Remarkably, at first, following these two rules was the hardest thing I ever did in my life. Today, I consider the M10 Anchor Timeframe rules my “specific patience parameters”. I only aggressively trade during confirmed M10 EMA9 trends, and scalp or wait when the M10 EMA9 trend has ended.

Song to the Siren

Price action is always flirting with you, but in most cases, not for the right reasons. The Siren’s song is irresistible, and when you swim to her, she drowns you.

When you get a broader understanding of my models and concepts, you’ll sometimes think that you know what is next. Stay humble, because when you try to participate in everything you see, you’ll wear yourself out before you get a good setup and might even find yourself stuck in an out of control trade.

It is oh so easy to come to the screen and say "I want a piece of that" and "it looks like a setup". Just zoom out and prepare that trade. Update yourt inter timeframe awareness, especially when M2 is basing, because it is so easy to get it wrong if you don't take enough time to prepare the trade. You'll take that, thinking I'm going to take a quick 1R. But the job is to prepare the trade and enter the market with the idea of losing 1R, to prepare you mentally. If you let your guard down for just a second, you can lose yourself and everything you’ve achieved, just like that. They'll get you every single time. You have to protect yourself, and it is just about that simple mental trick.

Now, I'll share an M10 chart that tells me when to engage aggressively, and when to be extra cautious.

This is how I look at it. All you have to do is wait, then trade in line with the system.

Now Straight From the Heart

I strongly believe that these potentially strong emotional responses to loss taking have deep roots in our primal instincts. Our money is linked to our survival, and therefore, when we lose money, our survival instinct is triggered. If we approach the market without a set of rules, we are exposed. Rules are not there to protect you. Rules are there for you to fully embrace the concept, the system, the models. If you truly believe that the system works, you will be able to

cut an error immediately, without as much as looking at a candle in hopes to get a good exit. Mistake? Kill, move on;

wait for the setup that you have chosen to wait for, and only that;

never engage in a trade without understanding where you will take the loss, and then calculate your size so that you risk only 1R or less;

trust that you'll continue to be successful if you wait for the next setup.

Impatience and mistakes are fine. Cut it, accept it, move on. I need rules just like anyone of us. Quick scalps are fun, but if one goes against me, it is just business. Before take it, you have to be prepared to lose that money. When it is gone, it is gone. Done.

One thing that I primarily notice is that those that struggle with profitability, don't only take losses, they also cut your winners to early. This is part of that same primal instinct. Holding losses with hopes to get back to green is our survival instinct trying to protect us. Cutting winners early is the exact same thing: protecting that win before you lose it. Trading requires us to do the opposite of what our primal instincts tell us to do.

H1 Buy/Sell Signal Worth Waiting For

My days consist of just trading my levels while I am waiting for the hourly buy/sell signals. On average, there is only ONE money wave every week, and they happen when H1 EMA21 crosses the 50. In fact, if you only wait for those, you'll trade once or twice a week, and make anything between 8 and 100R.

THIS is what the M10 Anchor and H1 Root timeframes set up for.

Patience will come from understanding that sub par scalps can be ignored. You don't need them to build account size.

Ready to Give Up?

During a marathon race, the longest mile of the whole run is the last mile. Your body is screaming at you to quit, to just give up, even though there is only one mile to go.

Right there where you desperately want to give up, that is typically the big turning point, where things are about to make a turn for the better. You have invested so much time, money and emotional capital into learning the concepts. Remember that an official statistic says that the sole reason why 95% of new startups fail, is simply because the CEO gives up. Nothing else.

Persistence is the key to succeeding - which makes sense, because nobody ever succeeded by giving up - right?

In the end, the choice is yours, and the only thing you have to terminate on your switchboard, is the idea that you can use the system to make an easy buck. Respect the market. Wait for the setups, and trade in line with the system.

If you struggle because you took losses and are afraid to lose more, take your time to rebuild confidence. Paper trade. Rebuild conviction. Set goals. Use M10 to flip the switch, stick with the rules and realise that in the end, trading is easy. Discipline is hard.

Really, I am not afraid of losing money. My greatest fear is that I will lose my discipline again. I consciously choose the discomfort of discipline over the pain or regret. - Barky

Visualisation

The more you struggle with market psychology, the more seriously you should embrace visualisation. Start your morning ritual with a visualisation session. Look at yourself in the mirror and tell yourself that you are great, successful, confident, smart, patient and brilliant. Tell yourself that your job is to wait for a conviction trade to set up, and that outside of that, you don’t take trade. Root yourself into your job description before you turn on the screen.

You see, visualisation taps into a powerful psychological state. You can do a search on this, and read how visualisation is a form of mental preparation. The brain can’t tell the difference between imagination and reality, and therefore, visualisation will allow you to put on confidence and focus as if it were a new jacket. Imagine yourself in that new jacket. You look so good, you feel so good, even though you just imagine it. You’ll even smile. When you imagine yourself applying the M10 Anchor Timeframe rules, patiently waiting for the right moment, then executing in line with the system’s rules for risk and position management, you are building neural pathways that program you for positive behaviour.

Christians call it gratitude and prayer, Zen Buddhists call it meditation, traders call it preparation. Mankind has used this technique for millennia, since the dawn of time.

You are starting today.