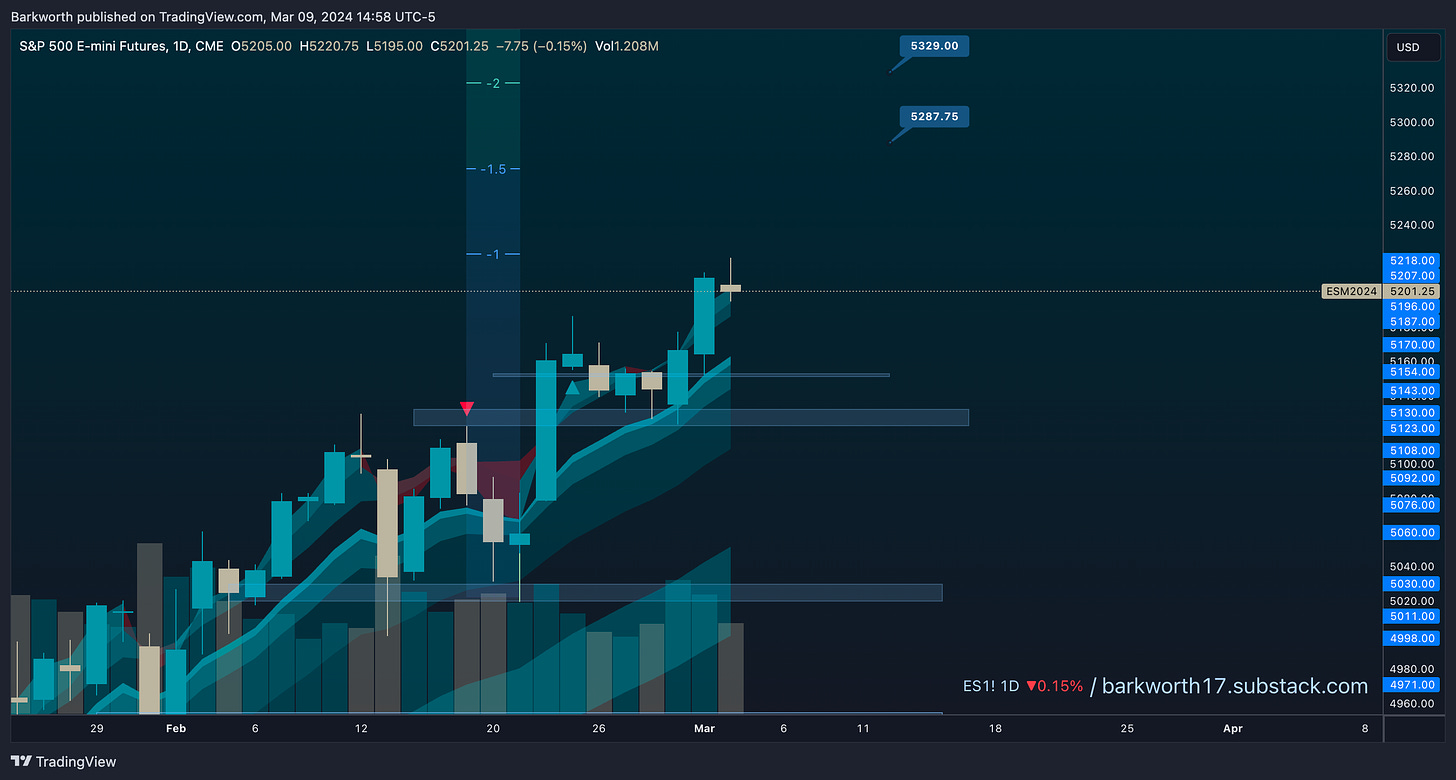

If you have read my instruction on how to balance risk for each trade let us next have a look at how that works in the grander scheme of things. First off, I get questions on down days, asking me why I am not short. If you look at the daily chart below, you see that markets are in an uptrend. In an uptrend, I want to look to buy dips.

This is a clear uptrend. Price is making higher highs and higher lows, and that evening start candle suggests that a pull back might happen. So if the coming session produces a daily pull back, we would get an hourly downtrend into support, and there I would look for a reversal to get long and attempt to trail into continuation higher.

A short works nicely on a day like this, but due to the uptrend, you never really know where price is going to bounce. You can see from the daily candle on the chart above, that the D1 EMA9 is leading, therefore, we should look for a partial retrace of that previous big green daily candle.

When this session played out, price actually dipped a lot deeper. Here is how that looked:

A short can work nicely on a day like this, but in uptrends, you never really know where price is going to bounce. You can see from the daily candle on the chart above, that price pushed through the D1 EMA9. That is not something you should expect in an uptrend, and though you might scalp the short, as a trend trader, our job is to look for the next long opportunity, as long as markets are in an uptrend.

Below is a look at the hourly.

A downtrend day like this typically gives two hourly lower lows before a bigger bounce. If the second lower low doesn’t produce a good bounce, there will be two new lows before the conviction buy sets up. This could be a bigger bounce or an immediate reversal.

In this case, price make four bounce attempts without making a single higher high. On the lower timeframe, this means that there were 4 long opportunities, 3 of which failed, and the 4th marked the bottom.

I traded all of these bounces, and used my risk and position management parameters to compound gains until finally, the fourth one followed through for 79 points. Without my risk management parameters, the three failed attempts would have eaten up the 79 points, and I would have ended the day flat, or with a nett loss.

I ended the day with three wins. How did I do that? By following the parameters and rules that I have explained in the Position Management and Balanced Risk instructions.

Let’s take each of the four trades apart, and see how negating risk is a solid, profitable business model.

Let’s say that our standard risk is $1000 per trade, and our account size is $20000.

The First Trade

This is the first long attempt. If you had taken the last entry opportunity, you risked 2 points for 3 points partials (the early entry had 5pt partials with a 2pt stop). With $1000 risk, that is $500 pr point. 3 points higher equals a profit of $1500, so when you locked in 75% at partials that was $1000.

When price made a higher high, your stop goes to break even - risk free trade. Smart players exited in profit when price headed lower on displacement and locked in the extra $500 on the runner, but let's leave those out of the equasion.

First trade: 1R / $1000 risked, $1000 profited. Here is the chart: