The Anchor and Root Timeframes

How to spot trends versus contraction stages for added directional probability

So far, we have looked at the Diagonal Entry Model as a continuation or reversal model and explored how we use the EMA9 across timeframes to tell us when to engage and when to lock in.

You may have understood that the Diagonal Entry Model is a trend trading tool, and it works only when there is an EMA9 trend. Now, where there are EMA9 trends on multiple timeframes, trading with the trend is an easy feat. When there are no trends on higher timeframes, for example during hourly turns or consolidations, lower timeframe setups become lower probability and we have to change our approach.

The 10 minute timeframe (M10) is key to identifying these two different modes of price behaviour. We have explored the significance of the M10 EMA50 in the previous instruction, and I have explained how and why I have framed my day trading rules.

In this article, we will explore the relationship between M10 and H1.

M10 Anchor Timeframe

M10 EMA50 to trade along H1 EMA9;

M10 EMA9 to guide M2/M5 setups.

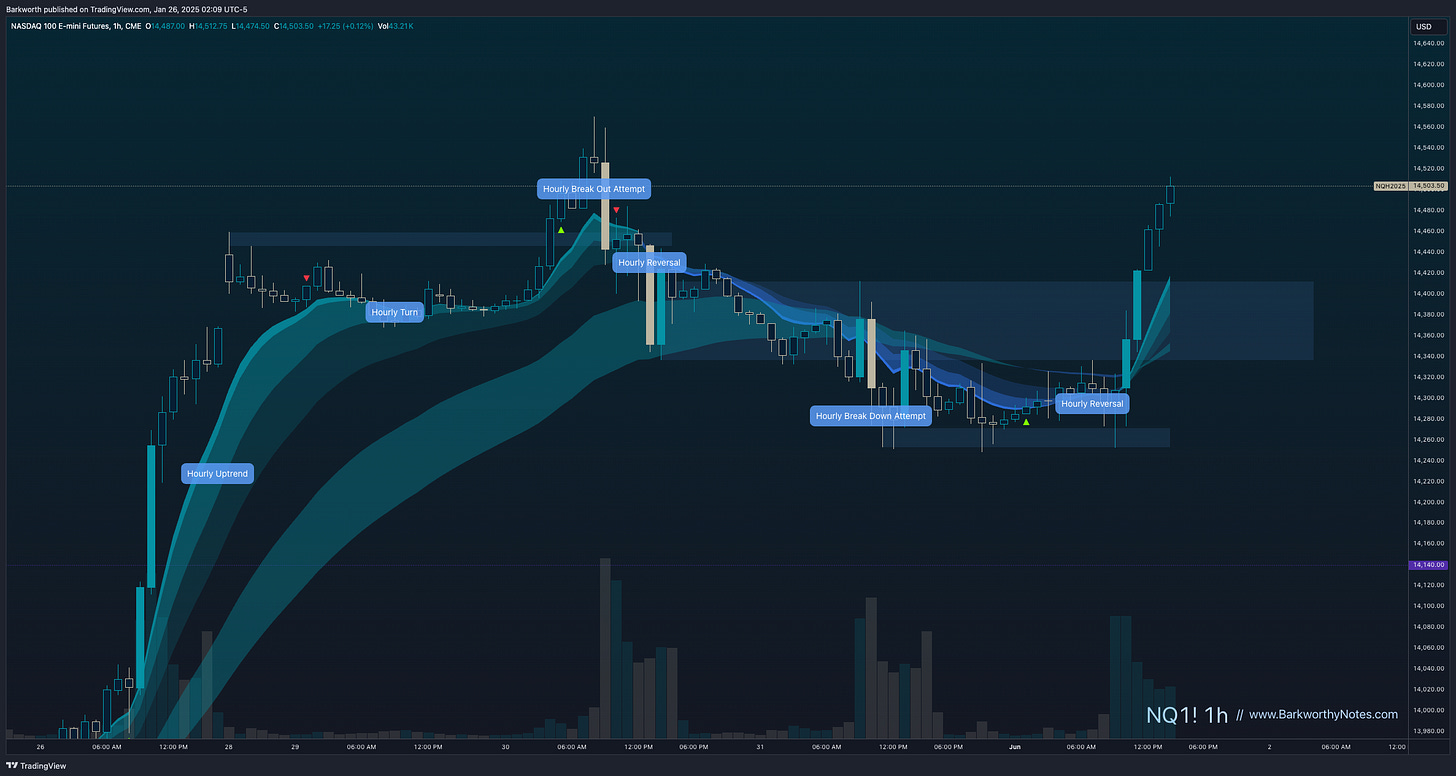

I think the best way for me to show explain how I look at price action, is through an example. First of all, it is important to understand that there are only two different market stages: contraction and expansion. As a trader, the highest probability to make money is when the hourly timeframe is trending (expansion). When hourly trends end, the initial turn still has upward momentum, but many lower timeframe break out attempts start to fail as the hourly timeframe is now consolidating (contraction).

Here is a simplification of trend structure. Wherever you poke on a chart, you will either find a consolidation or a trend. There is nothing else.

Study this diagram and look at H1 EMA9.

For the next slide, we will explore how the hourly structures look on the M10 timeframe, to illustrate how these trend structures align.

First we’ll have a look at the hourly failed breakdown attempt and the reversal. I want you to see the following things:

H1 EMA9 is going sideways through the candles and it doesn’t reject price;

H1 EMA50 is hovering above price and attempting to reject until at the end, buyers reclaim and break out;

M10 is chopping. There are good spikes for 40 to 50 points into both directions, but all of them get rejected. The M10 EMA50 is crossing through the candles, exactly like H1 EMA9.