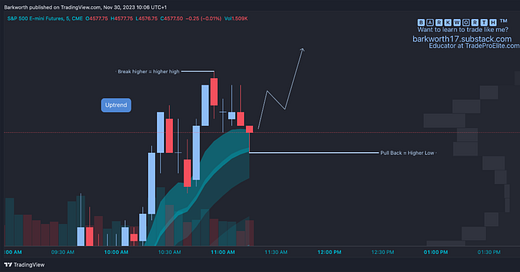

Pull backs in an uptrend are dips to be bought. We buy the dip on these add points, as buying into the faster moving averages has a high probability of producing a gain.

The pull back puts in the higher low and price is trending as long as it makes higher highs after pulling back. This dynamic produces the trend.

When we enter a trade, we have to let price tell us what it wants to do next. So here is an example. Price pulled back into EMA13 and a wick has formed to indicate demand. Traders have bought the dip in anticipation of continuation or scalps - different traders, different plans.

At some point a trend is going to end, indicating that price may need to consolidate for a longer period of time. The first indicator that this may be in play, is when price fails to make a higher high after a pull back. Price may now return to the higher low pivot.

The key price action principle to understand, is that if price breaks below the higher low pivot, it will confirm the first lower high since the trend started, and breaking below the higher low will put in the first official lower low.

Complicated? Here is how that looks: